Pension Review Background Paper

The Minister for Families, Housing, Community Services and Indigenous Affairs has asked the Secretary of FaHCSIA, Dr Jeff Harmer, to complete an investigation into measures to strengthen the financial security of seniors, carers and people with disability, including a review of the Age Pension, Carer Payment and Disability Support Pension. This review is part of the Government’s wider inquiry into Australia’s Future Tax System, chaired by the Secretary to the Treasury, Dr Ken Henry.

Context

Many people who rely on the income support system for a basic acceptable standard of living say that they are finding it harder to make ends meet.

The Senate Standing Committee on Community Affairs has drawn attention to the financial circumstances of older Australians with few assets who do not own their own home, particularly singles, private renters, and those with a limited capacity to work and/or save for retirement. Many of these people have a long-term reliance on the income support system. The committee recommended the Government review the suitability of the base pension levels through economic analyses of amounts required to achieve at least a modest standard of living for retired Australians.

The Government recently introduced a number of changes including one off payments to seniors and carers and an increase in the Utilities Allowance from $107 to $500 and its extension to disability support pensioners and carers in recognition of some of the pressures identified in the Senate Committee report.

Terms of reference

The Pension Review Background Paper provides information to help people understand how well the income support system works for those who rely on it. It addresses the Review’s three key terms of reference

- the appropriate levels of income support and allowances;

- the frequency of payments; and

- the structure and payment of concessions or other entitlements.

Principles of the social security system

The social security system redistributes Government revenue collected in the tax system to individuals and families to increase the wellbeing of the Australian population. It is part of a broader social protection system that includes direct expenditure on services and infrastructure (such as health, education and community services), the superannuation system—which complements the Age Pension in Australia’s retirement income system—and payments, services and investment to promote the efficient and effective functioning of the Australian economy which underpins individual and national wellbeing.

To work effectively, in addition to supporting a basic acceptable standard of living, taking into account prevailing community standards, the income support system has to:

- give greater assistance to those with additional costs either through transfer payments or services;

- target payments to those not able to fully support themselves;

- promote participation and self-provision through services, incentives to work and save, and obligations; and

- be sustainable.

Key Facts

Around 4.6 million Australians receive an income support payment of some kind from the Australian Government in the form of a pension or allowance (27 per cent of the population aged 15 years and over):

- in 2006–07, Australian Government expenditure on the income support system was $71.6 billion, or around 6.8 per cent of GDP

- 77 per cent of Australians over the age of 65 receive income support, and 17 per cent of Australians aged 16–64 years

- 59 per cent of income support recipients are women, and 58 per cent are single.

Australia’s population is ageing: 13 per cent of Australians are over 65 years now, growing to 25 per cent by 2047.

Even with the maturing of the superannuation system the proportion of retired Australians who receive the Age Pension will only decline slightly although many more will receive a part-pension in addition to their private income rather than relying upon the pension alone.

Many pensioners rely on income support for long periods. The average total time on income support of current Age Pensioners is 13.1 years. For Disability Support Pensioners, it is 10.8 years and for Carer Payment recipients it is 7.6 years. In most cases, these pensioners have moved on to their current payment from another income support payment.

Pension rates have grown by more than 2 per cent a year above inflation over the last decade, which is slower than average households (3 per cent), but higher than low wage earners (1 per cent).

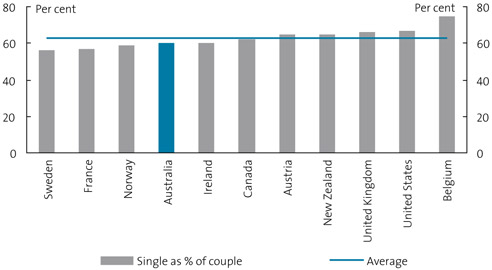

The single rate of pension is 60 per cent of the combined couple rate, lower than the average for major OECD countries (63 per cent).

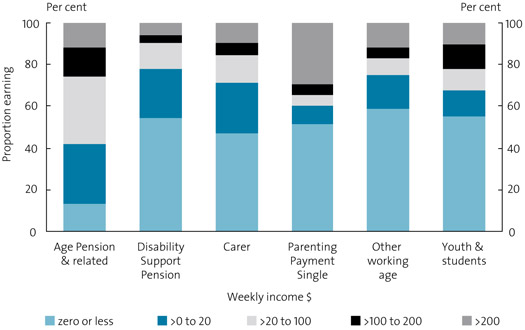

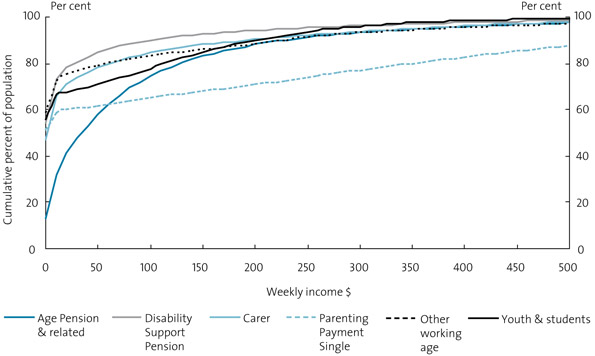

Most pensioners have low incomes: over half have less than $20 a week of private income, but some have higher incomes; 5 per cent have private incomes of over $400 a week.

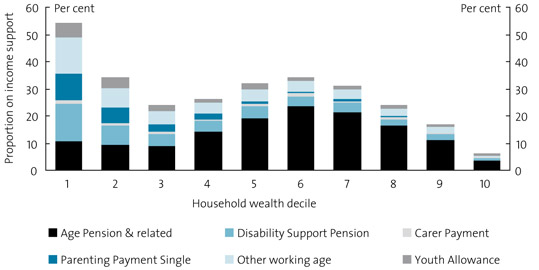

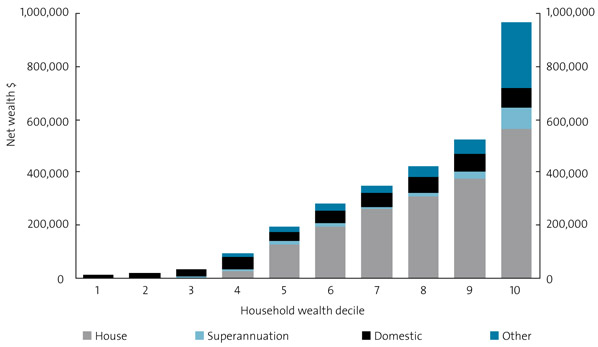

Most pensioners do not have substantial savings or other assets: over half have assessable assets (excluding the family home) under $30,000 and 30 per cent report having bank balances of less than $1,000, but some have higher assets with 5 per cent reporting assessable assets over $250,000. Pensioners are able to receive some pension with assets up to around $1,000,000.

The family home is a major form of savings for seniors: 61 per cent of Age Pensioners are homeowners; among Age Pensioner couples, 83 per cent are homeowners.

Few pensioners participate in work to supplement their payments: 4 per cent of Age Pensioners, 12 per cent of Disability Support Pensioners and 11 per cent of Carer Payment recipients.

Consultation

The Government has announced a public consultation process to ensure that individuals and community organisations can contribute to the work of the Pension Review. A series of public meetings in capital cities and major regional centres will commence in Darwin on 19 August. A written submission process has also been announced to allow the widest possible participation.

Acronyms

| ABS | Australian Bureau of Statistics |

| ALCI | Analytical Living Cost Index |

| ATI | Adjusted Taxable Income |

| CA | Carer Allowance |

| CCB | Child Care Benefit |

| CDAP | Child Disability Assistance Payment |

| CP | Carer Payment |

| CPC | Combined Pensioner Couple |

| CPI | Consumer Price Index |

| CSHC | Commonwealth Seniors Health Card |

| CSTDA | Commonwealth State Territory Disability Agreement |

| DEEWR | Department of Education, Employment and Workplace Relations |

| DSP | Disability Support Pension |

| DVA | Department of Veterans' Affairs |

| EdEP | Education Entry Payment |

| FaHCSIA | Department of Families, Housing, Community Services and Indigenous Affairs |

| FTB | Family Tax Benefit |

| GDP | Gross Domestic Product |

| HACC | Home and Community Care |

| HCC | Health Care Card |

| HILDA | Household Income and Labour Dynamics in Australia |

| MAA | Mature Age Allowance |

| MTAWE | Male Total Average Weekly Earnings |

| NSA | Newstart Allowance |

| OECD | Organisation for Economic Co-operation and Development |

| PA | Partner Allowance |

| PCC | Pensioner Concession Card |

| PES | Pensioner Education Supplement |

| PhA | Pharmaceutical Allowance |

| RA | Rent Assistance |

| RAA | Remote Area Allowance |

| SCA | Seniors Concession Allowance |

| SDAC | Survey of Disability, Ageing and Carers |

| TAL | Telephone Allowance |

| UA | Utilities Allowance |

| WA | Widow Allowance |

| YA | Youth Allowance |

Introduction

On 15 May 2008, the Minister for Families, Housing, Community Services and Indigenous Affairs, the Hon. Jenny Macklin MP, announced that the Secretary of the Department of Families, Housing, Community Services and Indigenous Affairs (FaHCSIA), Dr Jeff Harmer, would lead a review into measures to strengthen the financial security of seniors, carers and people with disability. This would include a review of the Age Pension, Carer Payment and Disability Support Pension as part of the Government's wider inquiry into Australia's Future Tax System, chaired by Dr Ken Henry.

Recent rises in cost of living pressures have led to concerns that people on low incomes—particularly those who are dependent on the maximum rate of pension and have few assets—may be finding it harder to make ends meet. The recent Senate Standing Committee on Community Affairs' inquiry into cost of living pressures on older Australians found that people on low incomes are disproportionately affected by rises in the cost of petrol, food, medical care and rental accommodation. It also found the maximum rate of pension may be insufficient to maintain a basic, decent standard of living, and those most at risk of financial stress are single pensioners receiving the maximum rate of pension and living in private rental accommodation. The committee acknowledged that certain groups are more likely to be wholly reliant on pensions, including older women, people with severe disability or chronic illnesses, and those whose earning ability has been limited by their caring responsibilities.

The Pension Review will investigate the appropriate levels of income support and allowances, the frequency of payments and the structure and payment of concessions or other entitlements for Age Pension, Disability Support Pension and Carer Payment recipients. The review will carefully examine options for reforming the pension system to ensure that any changes are sustainable in the long term.

The Pension Review Background Paper is designed to support the public consultation and submission process for the Pension Review. All interested people are encouraged to participate in the public consultation. Details about the consultation process and how to get involved are available on the FaHCSIA website at www.fahcsia.gov.au. The Pension Review will be completed by February 2009. The broader inquiry into Australia's Future Tax System will conclude by the end of 2009.

The wider inquiry into Australia's Future Tax System will consider improvements to the tax and transfer payment system for individuals and working families. This will include consideration of the relationships of the tax system with the transfer system and other social support payments, rules and concessions, with a view to improving incentives to work, reducing complexity and maintaining cohesion. Consultations will also be undertaken as part of the broader review. Further information on the Australia's Future Tax System review, including a copy of the architecture paper, is available on the tax review web site at www.taxreview.treasury.gov.au.

Readers of this background paper may also be interested in the report of the Senate Community Affairs Committee, A decent quality of life. On 20 March 2008 the committee released this report into the cost of living pressures on older Australians. The report made 15 recommendations to improve the financial wellbeing of older Australians.

The House of Representatives Standing Committee on Family, Community, Housing and Youth is also conducting an inquiry into Better support for carers, which was launched on 1 May 2009. More information, including copies of submissions to the inquiry, is available on its web site at http://www.aph.gov.au/house/committee/fchy/carers/index.htm.

1. Background

1.2 Income support in Australia

1.1 Scope of the review

The Minister for Families, Housing, Community Services and Indigenous Affairs has asked the Secretary of FaHCSIA, Dr Jeff Harmer, to complete an investigation into measures that might be adopted to strengthen the financial security of seniors, carers and people with disability, and to report by 28 February 2009 on the:

- appropriate levels of income support and allowances, including the base rate of the pension, with reference to the stated purpose of the payment

- frequency of payments, including the efficacy of lump sum versus ongoing support

- structure and payment of concessions or other entitlements that would improve the financial circumstances and security of carers and older Australians.

In addition, the Pension Review will inform the inquiry into Australia's Future Tax System through Dr Harmer's membership of the tax review panel. The inquiry has the broader role of reporting on 'improvements to the tax and transfer system for individuals and working families, including those for retirees'.

This discussion paper has three sections:

- Section 1 is an overview of Australia's income support system

- Section 2 outlines some key issues relating to the investigation's terms of reference

- Section 3 outlines key trends and characteristics of income support recipients.

While the focus of the Pension Review is on Age Pension, Carer Payment and Disability Support Pension, information is provided at various points on the income support system as a whole to recognise the flow-on issues for other payments.

There are many linkages between Age Pension, Carer Payment and Disability Support Pension and the broader income support system:

- many seniors, carers and people with disability receive one of the above payments or another income support payment, such as a Department of Veterans' Affairs (DVA) payment, and/or supplementary payments

- many of the policy settings that apply to these payments also apply to the other major income support payments (Parenting Payment, Newstart Allowance, Youth Allowance and the Service Pension) and affect the level of supplementary payments such as Rent Assistance and family assistance

- many recipients of the Age Pension, Disability Support Pension and Carer Payment are partnered with a person who receives one of these payments and their household income reflects the settings of both payments, in addition to Family Tax Benefit (FTB) if they have children

- a number of the supplementary and bonus payments available to people who get Age Pension, Carer Payment and Disability Support Pension are also available to people who receive other payments

- differences between payments add to the complexity people face in accessing support and can create incentives for people to gain access to payments which they perceive to be more favourable. In addition, many people move between payments as their circumstances change.

1.2 Income support in Australia

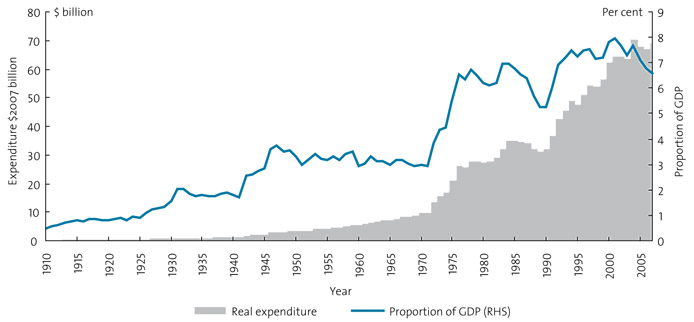

In 2006–07, Australian Government expenditure on the transfer system was $71.6 billion, or around 6.8 per cent of Gross Domestic Product (GDP). The largest program of expenditure was assistance for the aged at $26.1 billion.

Around 4.6 million Australians receive a pension or an allowance from the Australian Government as income support. Many more receive cash transfer payments for their families through the FTB, or may be eligible for concession cards or other assistance.

While for some these transfers supplement their own income from employment or savings, for others their pension or allowance is the sole source of income. Obviously, the settings and rates for income support are very important for people largely or wholly reliant on the system, particularly when they also have long durations on income support.

FaHCSIA, the Department of Education, Employment and Workplace Relations (DEEWR) and DVA are each responsible for a number of payments. These are mainly delivered through Centrelink, part of the Human Services portfolio, and DVA.

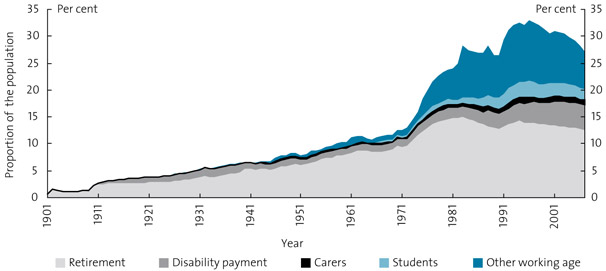

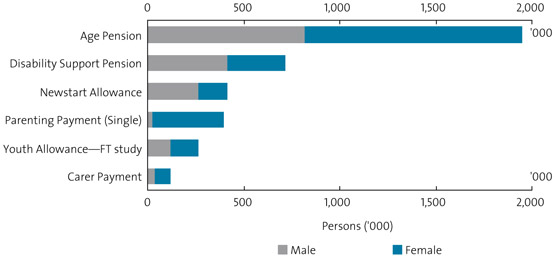

The largest payment is the Age Pension, which around two million older Australians receive, followed by the Disability Support Pension, with more than 700,000 recipients. While 3.5 million people receive payments classified as pensions, one million receive payments classified as allowances. Table 1 outlines the numbers of people receiving payments, and more information on payments is available in Section 1.2.3 and at Appendices A, B, C and D.

| Payments | Male | Female | Total |

|---|---|---|---|

| Pensions | |||

| Age Pension | 815,900 | 1,136,800 | 1,952,700 |

| Disability Support Pension | 413,400 | 300,800 | 714,200 |

| Parenting Payment Single | 26,000 | 369,500 | 395,500 |

| Carer Payment | 38,100 | 78,500 | 116,600 |

| Wife Pension | 0 | 35,300 | 35,300 |

| Widow B Pension | 0 | 700 | 700 |

| Bereavement Allowance | 100 | 500 | 600 |

| Service Pension | 112,600 | 98,000 | 210,600 |

| DVA Income Support Supplement | 100 | 84,400 | 84,500 |

| 1,406,200 | 2,104,500 | 3,510,700 | |

| Allowances | |||

| Newstart Allowance | 262,700 | 155,100 | 417,800 |

| Youth Allowance—Full-time study | 119,000 | 144,300 | 263,300 |

| Youth Allowance—Other | 34,600 | 34,100 | 68,700 |

| Parenting Payment Partnered | 12,700 | 131,700 | 144,400 |

| Widow Allowance | 0 | 40,200 | 40,200 |

| Partner Allowance | 4,600 | 41,400 | 46,000 |

| Austudy | 15,100 | 13,200 | 28,300 |

| Abstudy | 15,900 | 18,200 | 34,100 |

| Exceptional Circumstances Relief Payment | 23,000 | 5,600 | 28,600 |

| Sickness Allowance | 4,800 | 2,800 | 7,600 |

| Special Benefit | 3,100 | 3,100 | 6,200 |

| Mature Age Allowance | 5,000 | 0 | 5,000 |

| Farm Family Restart | 200 | 0 | 200 |

| 500,700 | 589,700 | 1,090,400 | |

| Total income support | 1,906,900 | 2,694,200 | 4,601,100 |

| Other payments/supplements | |||

| Family Tax Benefit Part A | 178,500 | 1,590,600 | 1,769,100 |

| Family Tax Benefit Part B | 154,800 | 1,222,100 | 1,376,900 |

| Baby Bonus | 286,800 | ||

| Carer Allowance | 96,000 | 297,300 | 393,300 |

| Mobility Allowance | 29,800 | 24,700 | 54,500 |

| Double Orphan Pension | 200 | 1,100 | 1,300 |

| Commonwealth Seniors Health Card | 318,300 | ||

| Low Income Health Care Card | 364,200 | ||

| DVA Disability Pension (a) | 133,400 | 6,300 | 139,700 |

| War Widows (a) | 300 | 110,300 | 110,600 |

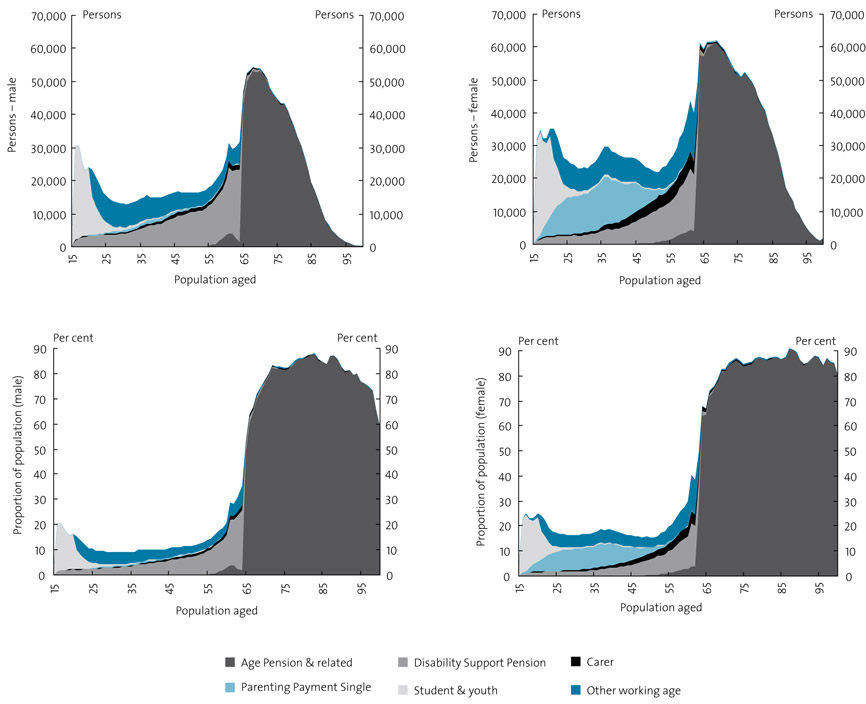

Around 59 per cent of income support recipients are women, with higher proportions among the pension population. Around half the income support population is aged under 63 years and around 58 per cent are paid as a single person. The characteristics and circumstances of people receiving income support are considered in more detail in Section 3. As is shown in Section 3.3.3, many people on income support rely on it for long periods. This is particularly evident for Age Pension and Disability Support Pension recipients.

1.2.1 Purpose and principles of the social security system

In essence, the social security system redistributes Government revenue collected in the tax system to individuals and families to increase the wellbeing of the Australian population. It is part of a broader social protection system that includes direct expenditure on services and infrastructure (such as health, education and community services), the superannuation system—which complements the Age Pension in Australia's retirement income system—and payments, services and investment to promote the efficient and effective functioning of the Australian economy, which underpins individual and national wellbeing.

The social security system primarily supports the broader social protection system by providing a safety net for Australians without the means to achieve a basic acceptable standard of living. However, there are other ways in which the design of the system helps Australians manage risk and change—for example, by providing security through periods of transition, such as the breakup of a relationship or a period of bereavement.

While the focus of the review is on appropriate levels of support and the frequency and structure of Age Pension, Disability Support Pension and Carer Payment, the social security system plays a key role in advancing the objectives of the broader social protection system, such as social and economic inclusion.

1.2.2 Design principles

The social security system has to balance a number of objectives, and it reflects the accumulation of past initiatives that responded to the social and economic pressures of the time. In looking across the system, it could be said there are five key principles underpinning its design.

It supports a basic acceptable standard of living, accounting for prevailing community standards. Payments are not related to past earnings and do not compensate for pain, suffering or loss of amenity.

It is equitable. It treats people in similar circumstances similarly. Those with additional costs are given greater assistance either through transfer payments or services to help them achieve a similar living standard. In some circumstances, these additional costs are recognised across a range of income levels.

It targets payments to those not able to fully support themselves. Those with their own resources and therefore the capacity to support themselves do not have the same need for transfers. Income and assets tests are used to reduce payments for people with private resources.

It promotes participation and self-provision through a combination of:

- services and assistance to help people deal with disadvantage (including disability, caring, improving skills and seeking work)

- incentives to work to provide for current needs and for retirement —for example, through contributions to superannuation

- obligations to work and to seek suitable work for those who are expected to, and the use of private savings to support themselves for those with savings.

It is sustainable. The broad community accepts that those who receive social security payments are in genuine need and that the overall system is affordable across the economic cycle and in the long run, given the ageing of the population.

1.2.3 Design features of current system

Governments have given a different emphasis to these principles at different times. These principles must be balanced against each other, because there are significant tensions between them. This has created six key features of the Australian system that together define its distinctive character (as opposed, for example, to the social insurance models used in OECD countries where individuals receive benefits based on contributions and/or prior earnings):

- categories of eligibility

- rates of payment

- income and assets testing

- obligations

- supplementary payments

- services and concessions.

While many of these design features also apply to payments made by DVA, such payments also have a more specific objective which is to compensate veterans and their dependents for the effects of war or defence service.

Categories of eligibility

The aim of ensuring that everybody in the community achieves a basic standard of living has to be balanced with the expectation that those with the capacity to support themselves will do so. To do this, the social security system supports people only if they meet eligibility criteria based on their ability and availability to work or if the community expects they do not have to work to support themselves.

For working age people, Newstart Allowance is paid on the basis that a person is expected to actively seek and accept suitable work, consistent with their ability and availability. However, some groups are not expected to work. This may be because they:

- have already reached a specific age (Age and Service Pensions) or experienced a recent bereavement (Bereavement Allowance)

- are undertaking a significant caring role and are not expected to look for or accept additional work (Carer Payment and Parenting Payment)

- are undertaking an activity that will improve their long-term ability to work (Youth Allowance [Student], Austudy and Abstudy)

- are unable to undertake significant part-time work due to disability (Disability Support Pension)

- are unable to work or study due to illness, but they have employment or study to return to (Sickness Allowance).

While not all groups are expected to work, individuals are encouraged to work, where this is appropriate to their circumstances, and payments are structured to enable them to gain financially from this participation.

The balance between providing support and the expectation that those with the capacity to support themselves do so works out differently for these different groups. Broadly, payments fall into two groups: pensions and allowances (formerly referred to as benefits). Pensions are generally paid at higher rates with more relaxed means tests. Allowances are paid at lower rates with tighter means tests.

The differences in the rates and conditions of pensions and allowances partly reflects the different rationale for allowances, which historically have been designed to provide temporary assistance, and pensions, which are for longer term assistance.

Details of social security system eligibility categories are at Appendix A. Details of expenditure and recipients of payments are at Appendix B.

Rates of payment

The rates of income support given to each individual have to balance providing a basic acceptable standard of living, promoting equity between individuals and providing incentives for people to support themselves where possible. They must also be sustainable.

The income support system pays a higher rate to single people than to each member of a couple. This recognises that a single person living alone usually does not have the economies of sharing household expenses commonly experienced by a couple. The single rate is currently 60 per cent of the combined couple rate.

Some rates of payment for younger people and students assume that, even when single, these people share accommodation or could reasonably be expected to do so.

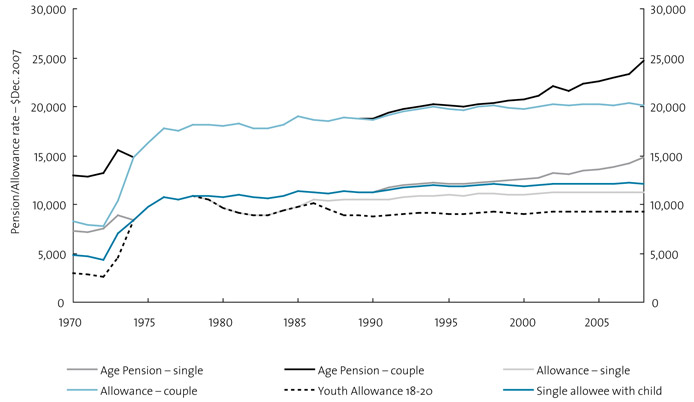

The maximum rate of pension for 20 March to 19 September 2008 is:

- $546.80 per fortnight for a single person (or around $14,216 per annum)

- $456.80 for each member of a couple (or around $11,876 per annum).

The equivalent rates for allowances for the same period are:

- $437.10 or $472.80 for singles (or around $12,292 per annum at the higher rate). The higher rate is paid to those with a dependent child or aged 60 or over after nine months

- $394.40 per fortnight for each member of a couple (or around $10,254 per annum).

The lower rates of allowances provide incentives to work but also make pension payments relatively attractive.

People with substantial levels of care of dependent children have access to FTB to assist with the additional costs of children. FTB payments can also constitute a significant proportion of a family's income. At June 2007, around 68,000 recipients of Age Pension, Carer Payment or Disability Support Pension were also receiving FTB for dependent children in their care.

In the current system, improvements in community living standards achieved through the productivity gains of the labour force are passed on to pension payments through benchmarking the maximum rate of single pension to 25 per cent of Male Total Average Weekly Earnings (MTAWE). MTAWE benchmarking applies to Age Pension, Carer Payment, Disability Support Pension (and other pensions) and indirectly to FTB. Other payments are indexed by the Consumer Price Index (CPI) to maintain purchasing power in line with overall price changes across the community.

Details of rates of payment are at Appendix C and supplementary payments at Appendix D. Indexation arrangements are described at Appendix E and historical trends in transfer payment are outlined in Appendix F.

Income and assets testing

Separate income and assets tests assess the personal resources available to income support recipients and calculate how much assistance is payable. Both tests aim to capture all income and assets of pensioners and allowees. However, in practice income from different sources is treated differently to encourage particular outcomes or equalise treatment between groups (for example, income from superannuation is assessed differently to income from shares). There is also a series of exemptions, the most significant being the exemption of the family home from the assets test (although higher assets test thresholds apply for recipients who do not own a home).

The primary goal of these arrangements is to target assistance to those most in need. This ensures that the system remains sustainable, both fiscally and in terms of community support. However, the arrangements also provide incentives for self-provision by rewarding workforce participation and saving. To balance these two principles, the social security system uses income and assets free areas and tapered income tests (and tapered assets tests for pensions) to attempt to ensure that those making the effort to provide for themselves are better off when they work or get more income from their savings.

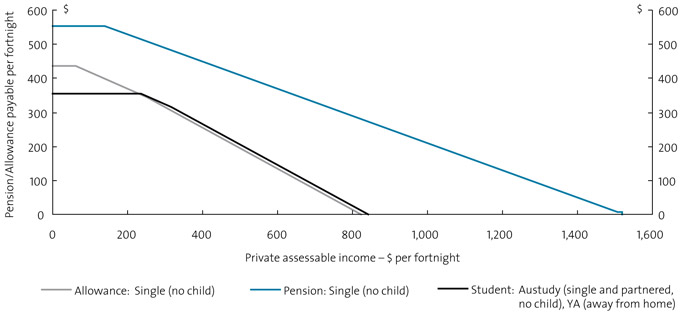

Chart 1 shows how the two components of the income test operate—an initial 'free area' where private assessable income has no impact on the rate of pension or allowance, and then a taper over which the amount of payment paid is reduced as the person has higher levels of private income. The rate of the taper varies between payments, but in all payments (other than Special Benefit) it is designed so people gain an increase in total income as private income increases. This basic architecture also means the full value of increases in the maximum rate of pension, whether by indexation or ad hoc, flow to all pensioners across the income distribution and result in additional people who may have been excluded due to their level of income becoming eligible for a part pension.

Chart 1. Illustration of the operation of the income test

Because the income support system's interactions with the labour market, and the retirement income system's interactions with superannuation, are important to the way Australians manage risk and change, incentives have been a focus for policy development.

In the last 14 years there have been major changes to income and assets tests. They have been relaxed to improve returns from work and incentives to save for retirement. These relaxations increased payments to those with private income and assets, and allowed others in this group to access income support for the first time.

The pension income test taper rate was lowered from 50 per cent to 40 per cent in July 2000 when the GST was introduced to improve work and savings incentives. Currently, a pensioner couple can have up to $66,000 a year in assessable income and receive some pension.

The pension assets test taper rate was halved from 20 September 2007 to increase incentives for saving for retirement and workforce participation as part of superannuation reforms. Under this change, pensions are now reduced by $1.50 per fortnight for each $1,000 in assets above the free area. The change means a homeowner couple can have up to $856,000 in assessable assets (in addition to the exempt home) and receive some pension. Prior to the change the limit was $531,000.

Under changes in 1995 and 2006, allowance income test taper rates have been lowered. They were initially reduced from 50 and 100 per cent withdrawal rates before July 1995 to a taper of between 50 and 70 per cent. In July 2006 these were further reduced to 50 and 60 per cent to improve incentives for part-time work for second earners and as a pathway to full-time employment.

While the income and assets tests reduce payments to people earning additional income, elements of the social security system support and reward participation to reinforce the benefits of self-provision. These include:

- Working Credit, which encourages income support recipients under Age Pension age who have accumulated sufficient credits to take up full-time, part-time or irregular casual work by allowing them to keep more of their income support payments when starting work

- Pension Bonus Scheme, which encourages people to stay in the workforce longer by providing a lump-sum payment to those continuing to work instead of those claiming a pension after Age Pension age

- concession cards, which can be retained for a period if a person aged under Age Pension age leaves payment due to their own or their partner's earnings

- Disability Support Pension with return-to-work 'suspension' provisions, which allow recipients who leave payment due to earnings to return to payment within two years (if they later cease work or reduce their earnings below the income test limit)

- Carer Payment arrangements, where recipients can participate in employment, education, training or unpaid voluntary work for up to 25 hours a week without it affecting their eligibility (increased from 20 hours a week before April 2005 and 10 hours a week before July 1997)

- a range of offsets within the personal taxation system that operate to reduce the effective tax rate on income for income support recipients and low-income earners. For example, in 2007-08 a single Age Pension recipient did not pay tax until their income exceeded $25,867.1

Other features of the income support system seek to ensure that different circumstances of households in providing support are accounted for. For members of a couple, for example, the partner's income and assets are taken into account on the basis that they are expected to share resources. In the case of family assistance and some young people on Youth Allowance or Abstudy, a parental income test recognises that parents are generally expected to support dependent children. Reflecting the exemption of the family home from the assets test for owner occupiers, non-homeowners have a higher assets test free area.

Details of income and assets testing are at Appendix C.

Obligations

While the income and assets tests provide incentives, obligations also play a complementary role in reinforcing the expectation that those who can support themselves do so. Obligations add integrity and sustainability to the social security system by assuring the community that assistance is provided only to those taking reasonable steps to support themselves.

There are broadly three types of obligations.

- Activity testing arrangements ensure that those with a capacity for work and who are expected to work undertake activities that will maximise their chances of finding and taking up suitable work. Activity testing only applies to Newstart Allowance, Youth Allowance and Parenting Payment recipients with a youngest child aged 6 to 15 years.

- Income test rules ensure that those who have financial resources use them to support themselves. The liquid assets waiting period means applicants for certain allowance payments—Newstart Allowance, Sickness Allowance, Youth Allowance and Austudy—have to serve a waiting period of up to 13 weeks if they have liquid assets (such as bank savings) over certain levels. Gifting rules mean income support recipients who give away assets or income above a threshold value may continue to have the value of the gift included in their assessed assets for five years and deemed to earn income in the same way as a financial asset.

- Direct and indirect obligations to support children. Under the Child Support system non-resident parents are obliged to support their children. More recently, the development of income management approaches ensures people who get payments use them for the purposes for which they were provided.

Supplementary payments

Supplementary payments provide a way of ensuring that people with additional costs achieve a similar standard of living.

Supplements recognise specific costs faced by particular groups which have not otherwise been met through direct services and which cannot reasonably be met out of the basic payment alone. For example, Rent Assistance recognises that people in the private rental market can face higher costs than people who own their own home. Apart from some payments in the DVA's system, supplements have not been used to compensate for pain and suffering or loss of amenity.

Supplements have also been used to compensate for changes in government policy (Pharmaceutical Allowance to compensate pensioners for the introduction of the co-payment for prescription medicines in the early 1990s) and to deliver assistance on a different frequency from the fortnightly pension payments and recognise specific costs, such as Utilities Allowance and Telephone Allowance.

From 20 March 2008, the Australian Government increased Utilities Allowance to $500 per annum for singles or for couples combined and increased the Seniors Concession Allowance from $218 a year to $500 a year for around 320,000 Commonwealth Seniors Health Card holders and certain Gold Card holders. While the Utilities Allowance is paid at the same rate for singles or couples—that is, $500 for singles and $250 for each member of a couple—the Seniors Concession Allowance is paid at a flat rate of $500 to both singles and each member of a couple. Also from 20 March 2008, the Government increased the rate of Telephone Allowance from $88 a year to $132 a year for around 800,000 veterans, income support recipients of Age Pension age, Commonwealth Seniors Health Card holders and recipients of Carer Payment and Disability Support Pension who have a home Internet connection.

In addition to these longer standing supplementary payments, government has, from time to time, paid bonuses to some social security recipients at the end of the financial year. Some payments are made regularly (such as the Child Disability Assistance Payment and FTB supplements) and others are ad hoc (such as the Seniors Bonus and the Carer Bonus).

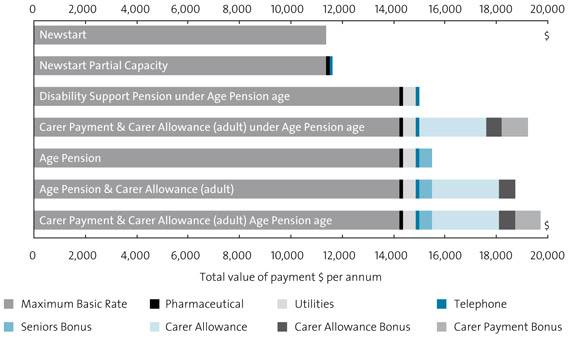

In combination, these supplementary and bonus payments have increased the total amount provided to many income support recipients well above the base rate of payment. The bonuses have also significantly altered the relationship between various income support packages received by different groups, and created incentives to access particular payment types.

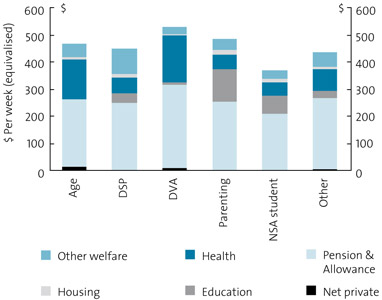

Chart 2 illustrates the different levels of support given to different categories of beneficiary.

Chart 2. Income support packages for selected single recipients, June 2008

Details of supplementary payments are at Appendix D. Further information on ad hoc lump sum payments is at Appendix G.

Services and concessions

The social protection system includes payments, services, concessions and subsidies. Services and concessions (through discounted fees and user charges) have an important impact on the wellbeing of income support recipients and other low-income households. Concessions and services that are directly linked with the receipt of Australian Government pensions and allowances (for example, through concession cards) can also enhance the total value of these payments. As such, the loss of support when paid work is undertaken can be greater than just the withdrawal of the primary payment. To address this, concession cards are available for a period on return to work, and alternative concession cards are available to some beyond the pension and allowance cut-outs.

Services and concessions have three main roles:

- to directly lower the cost of living for income support recipients and other low-income households by reducing the costs of goods and services they need to buy. Such reductions relate to a wide range of government, and often private sector, services and charges

- to ensure and promote access to key and essential services, including health, considered necessary for a basic quality of life and to enable people to fully participate in society

- to respond to the wide range of needs and circumstances of income support recipients. For example, different types of disability require different health, disability and other services. Through direct service provision the costs associated with such services can be met by government and targeted to those who need them.

One mechanism used for accessing services and concessions are concession cards, which provide discounts to cardholders at the point of access to the good or service. These concessions include discounts on prescription pharmaceuticals (funded by the Australian Government), and public transport, rates, utilities and motor vehicle assistance (provided by state, territory and local governments). Pensioner Concession Card holders, Health Care Card holders and Seniors Concession Card holders receive different concessions, as outlined in Appendix H. Section 2.3.1 discusses how social assistance in kind is distributed. Unlike other components of support, such as payments which taper away with increasing incomes, concession cards are usually retained until the person extinguishes all entitlements. Because the loss of the card may result in a sharp drop in the overall level of assistance received while on income support, this can produce strong incentives for people to remain eligible for quite low rates of payment, only leave payment for employment for a short period, or take other actions to ensure retention of the concession card.

Because the value of concessions and subsidies is targeted to usage, discounts can contribute to the equity principle by providing the greatest benefit to those who make more use of services such as pharmaceuticals or public transport. Some private companies also use concession cards to target price discounts. However, given that the value of concessions increases with consumption, concessions can also provide a greater benefit to those with more private resources.

2. Terms of reference

2.2 Frequency of payments, including the efficacy of lump sum versus ongoing support

2.1 Appropriate levels of income support and allowances, including the base rate of the pension, with reference to the stated purpose of the payment

Chapter 1 noted that providing a basic standard of living for those not able to support themselves is a key principle of the income support system. Every citizen should be able to meet their basic needs and participate in Australian society.

The benchmarking of pension payments to 25 per cent of the MTAWE links pension rates to community living standards. In effect the provisions operate as an adequacy benchmark. Chapter 3 illustrates how this approach has driven real increases in pension rates.

The first terms of reference poses the question: do the current rates and the 25 per cent of MTAWE benchmark meet the objectives of the system?

This issue is particularly important for those who are wholly reliant on income support and do not have private income and assets to assist with cost of living pressures, for example:

- some people with disability may be dependent on Disability Support Pension for most of their adult lives

- carers of children with disability who, because of their caring responsibilities, may not have the opportunity to work for many years and build up assets

- people with disrupted work histories may not have been able to save for their retirement or purchase a home.

Chapter 3 provides data on private income and asset levels for a number of income support groups.

These settings are significant for people who have to rely on income support for long periods. Chapter 3 also provides information on income support durations and movement between payments. The average durations of current recipients on income support is 13.1 years for Age Pension, 10.8 years for Disability Support Pension and 7.6 years for Carer Payment recipients. The proportion of new maximum rate Age Pensioners who come from another income support payment is extremely high: 82.9 per cent for men and 89.6 per cent for women.

This section discusses data on a range of fixed and relative adequacy benchmarks and measures, including information on comparative rates of real income growth, replacement rates, international comparisons, budget standards, relative income measures, and outcome measures of stress and hardship. Also included are data on price changes for different groups.

Care needs to be taken in interpreting these benchmarks and measures.

There is no one way to determine whether a benchmark like 25 per cent of MTAWE is set at the right level. There is a need to look to a range of measures to judge whether current payment rates are appropriate.

Equally no one benchmark can definitively set a level at which an income support payment is adequate for all needs and all people. While the measures are useful guides, it does not follow, for example, that every person below 25 per cent of the MTAWE, or a relevant budget standard, has inadequate income for their needs.

2.1.1 Rates of income growth

Chapter 3 shows that the real value of the support paid to pensioners and families with children has increased over time, and the question arises as to how this compares with the experience of the wider community.

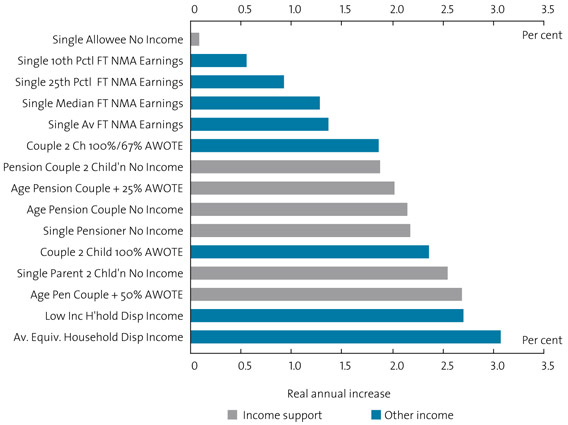

Chart 3 presents a number of comparisons of relative growth in real disposable income over the past decade. It draws from multiple sources, including surveys and estimated after tax earnings of a person on various levels of income. It shows:

- an Age Pensioner with no income other than the Age Pension had, on average, a real increase of just over two per cent per year

- there is a wide variety of outcomes for different groups—wage earners in the bottom half of the earnings distribution experienced lower real income growth than Age Pensioners wholly reliant on income support, while a couple with two children on average wages experienced higher real growth.

Chart 3. Comparison of real rates of income growth over the past decade

2.1.2 Replacement rates

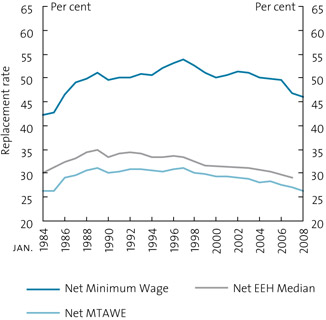

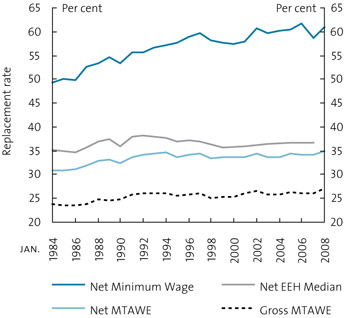

Three such replacement rates are in Chart 4 and Chart 5. These show the single allowance and single pension rate respectively as a proportion of the net income of a single worker on the minimum wage, MTAWE and earning the median of full-time non managerial employees' wage (as reported in the ABS Employee Earnings and Hours survey).

Chart 4 and Chart 5 show, for example, that the replacement rate for a single allowee as at 1 January was 45.9 per cent of the net earnings of a minimum wage worker and the Age Pension was 61 per cent. These different results reflect the different policy rationales behind pension and allowance payments, as noted in Chapter 1.

Chart 4. Replacement rates – single allowee

Chart 5. Replacement rates – single pensioner

2.1.3 International comparisons

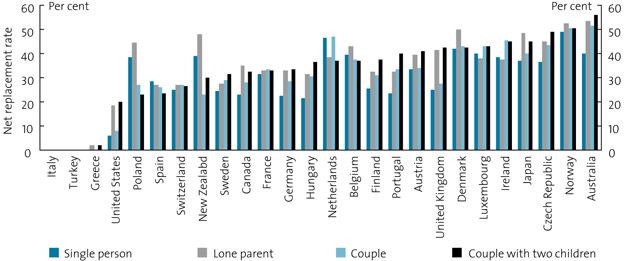

Replacement rates can also be compared across countries.

When compared with other countries, Australia's transfer system provides working aged families and individuals with a higher replacement rate of income in periods of sustained unemployment or other joblessness than the equivalent social assistance component of most other OECD countries (although short-term income related insurance type payments in some countries are higher).

Chart 6. OECD – social assistance as a proportion of household income

As these replacement rates are based upon allowance rates only, the actual assistance and replacement rates of a high proportion of income support recipients will be higher as they are eligible for pension rates of assistance rather than allowance rates.

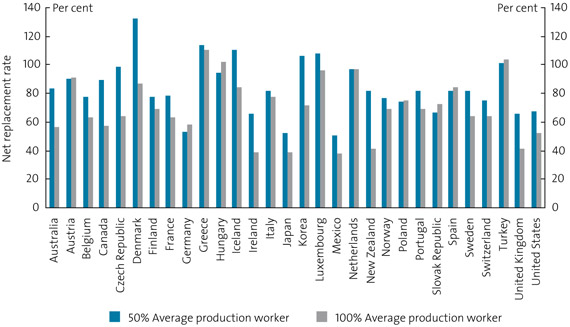

Australia's replacement rates for retirement incomes are not as high relative to other countries, many of which operate contributory earnings related public pension schemes; however, the sustainability of many of these systems is questionable. Chart 7 compares replacement rates relative to the net earnings of a worker on 50 per cent and 100 per cent of the OECD defined national Average Production Worker wage.

Chart 7. OECD – retirement income systems net replacement rates for a worker on 50 per cent and 100 per cent of average earnings

Australia's results will change in the future as superannuation assets build and feed into increased private retirement incomes. Nevertheless, the results indicate that Australia, out of the 30 countries surveyed, has the 12th highest replacement rate for low-income workers but because of the more limited level of superannuation assets built up by current retirees the country is ranked less highly at higher earnings levels. The net replacement rates for a worker on 50 and 100 per cent of average full time earnings in Australia in 2035 are expected to be 91 and 65 per cent respectively.

2.1.4 Budget standards

Budget standards involve developing detailed household budgets specifying the items a household needs to buy to achieve a defined standard of living and therefore can be used to identify the disposable income needed to obtain that standard of living. As with all approaches to measuring adequacy, these standards have strengths and weaknesses and are subject to considerable debate on whether they represent appropriate levels of living and can realistically reflect the diversity of living arrangements and trade-offs that households make.2

The Social Policy Research Centre at the University of New South Wales developed budget standards in the mid-1990s. These included some 600 individual products derived from research on household expenditure. Budgets were developed for two levels:

- a median living standard, described as the 'situation of a household whose living standard falls somewhere around the median standard of living experienced within the Australian community as a whole'

- a low-cost budget, described as 'a level of living which may require frugal and careful management of resources but would still allow social and economic participation consistent with community standards and enable the individual to fulfil community expectations in the workplace, at home and in the community'.

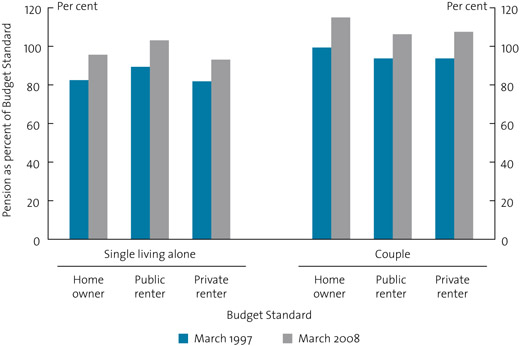

Chart 8 presents an update of the basic budget for aged single and couple households in a range of housing tenures using CPI. In effect, the cost of the basket of goods in the original standards has been adjusted to account for detailed price changes but the products in the original budget standards have not been adjusted for any change in community living standards.3

The results are shown in terms of the value of the pension for the particular household types as a proportion of the budget for that household type (for example, in March 2008 it is estimated that a single private renter on the Age Pension received 93 per cent of the low-cost budget standard from their Age Pension and Rent Assistance).

As illustrated in Chart 8, the Age Pension has increased relative to the budgets over the past decade. In March 2008, the Age Pension rate for single homeowners and single renters was below the relevant budget standard, and the rates for all couple household types were above the standard.

Chart 8. Age Pension as a percentage of budget standards

2.1.5 Relative income measures

Sometimes labelled 'poverty lines', relative income measures show the percentage of a population with incomes less than a proportion of an average or median household. A commonly used measure is 50 per cent of median household income (adjusted for household size). In much public debate, all households below the 'poverty line' are assumed to have inadequate income. However, care needs to be taken in interpreting relative income measures. 4

Not everyone below a relative line will have too little income to achieve a basic standard of living. Relative income definitions of poverty are quite poor at identifying households that actually experience hardship and financial stress.

Because they use relative disposable income, these measures ignore the extent to which support for low-income households may be provided through non-cash transfers such as services.

Also, a relative benchmark often moves with changes in the distribution of income in the broader population rather than real increases or decreases in the disposable income of people on low incomes.

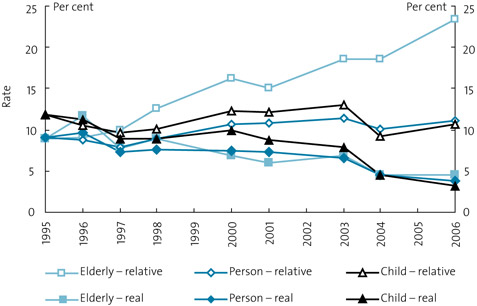

Chart 9 shows two approaches to such measures. The first uses the income of a household with 50 per cent of the household median income in 1994–95 to establish a poverty line which is maintained in real terms by adjusting for price inflation ('real' measure). The second tracks the proportion of the population with disposable incomes of less than 50 per cent of the median household income over time—that is, the 1996 results use the 1996 median household ('relative' measure). The chart shows three rates for each of the approaches: Persons, the proportion of the total population who live in households with an income below the low income line; Elderly, the proportion of people aged 65 years and over who live in households with incomes below the low income line; and Child, the proportion of children under the age of 15 years who live in low-income households.

The two approaches show divergent results. Using the constant real line there has been a marked decline in the incidence of low incomes across the population. Real increases in income support and wages have, in effect, moved many households above the poverty line that was set using 1994–95 median household income. In contrast, if a purely relative approach is taken there has been an increase in the poverty rate for the population as a whole. In 2005-06 it is estimated that 11.1 per cent of the population lived in households with less than 50 per cent of the 2005-06 equivalised disposable income of the median household, and 3.8 per cent lived in households with incomes below the 1995-96 benchmark adjusted to 2005-06 dollars. For the elderly the rates were 23.4 per cent under the relative measure and 4.6 per cent using the real benchmark, and for children 10.7 per cent and 3.2 per cent.

Chart 9. Relative and real low income measures

(Proportion living in households with equivalised disposable incomes below 50 per cent median equivalised disposable income, relative and real measures)

As noted above, this approach only considers current cash incomes rather than the wider set of resources available to households. An important component omitted is the benefits homeowners gain from owning their homes and not paying rent, along with the subsidies provided to public housing tenants. Taking these into account, using FaHCSIA estimates results in a fall in the relative measure in 2005–06 to 6.1 per cent5. For some household types the change is even more dramatic: for single persons over 65 years the rate drops from 47.4 per cent to 7.0 per cent, and for couples in this age group it drops from 19.0 per cent to 4.8 per cent.

The broad picture these data present is similar to that seen in considering the relative growth of income for different household types. Low-income households have maintained or increased their incomes in real terms, but for many the rate of increase has been lower than that for other groups in the community.

2.1.6 Financial stress indicators

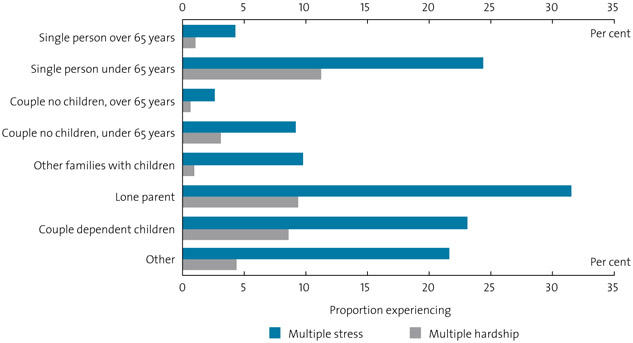

The Household Income and Labour Dynamics in Australia (HILDA) survey found that Australian households, including pensioner and allowee households, when asked, do not generally nominate themselves as poor. Most are satisfied, although a significant group consider they are 'just getting along' (50.1 per cent of households relying on income support for 90 per cent of their income).

Self-reported rates of financial stress (for example, could not pay electricity, gas or telephone bills on time; could not pay the mortgage or rent on time; asked for financial help from friends or family) or hardship (for example, pawned or sold something; went without meals; was unable to heat the home; and asked for help from welfare/community organisations) are also low, although with some significant pockets of multiple stress and hardship. For example, a recent study by Edwards et al (2008) found that carers experienced financial hardship at around double the rate of the general population. Chart 10 illustrates the levels of stress reported by households with more than 50 per cent of their income from transfer payments.

Chart 10. Transfer reliant households: incidence of financial stress, 2006

While providing some insight into the adequacy of payments, the incidence of poor outcomes reflects a much wider set of factors. These include the full range of resources such as wealth and access to services, and personal characteristics, competencies and behaviours. While a certain level of income appears to be more than adequate for some households and individuals, others, despite being in similar situations, may find it inadequate.

This highlights that decisions on the adequacy of income support need to account for the role services play in meeting specific needs, especially for those who due to health or other reasons would otherwise face high costs.

2.1.7 Singles and couples

The difference between the single and couple rates of pension also has an important effect on the adequacy of payment for specific groups. As noted in Chapter 1, the single-couple rate reflects the fact that a single person living alone usually does not have the economies of sharing household expenses commonly experienced by a couple. The single rate of pension is currently 60 per cent of the combined couple rate.

Chart 11 shows how the single-couple ratio in Australia compares with the relativities in other major OECD countries, which fall into a range from 57 per cent to 75 per cent, but somewhat below the average value of 62.9 per cent (the median value across these countries is 62 per cent).

Chart 11. International comparison of single–couple relativities

FaHCSIA analysis using a range of data including the ABS Household Expenditure Survey, HILDA and budget standards has sought to estimate 'equivalences' between couple and single person households using 14 different approaches. These included the relative incidence of financial stress and more econometrically based approaches using shares of food expenditure and types of private consumption. These measures of equivalence ranged from 0.6 to 0.79.

It should also be noted that this type of analysis only considers the relativities between household types – that is, a single person household compared with a couple only household. Other types of household have different relative needs – for example, a single person living with others compared with a couple living together. While the gains from this type of sharing may not be as great as those obtained by a member of a couple, the costs are likely to be substantially below those of a person living by themselves. Typically, the relative income required by a single renter living alone is higher than that required by a couple renting.

These comparisons of single-couple equivalences are consistent with the analysis of a range of measures in earlier sections of this report, including the budget standards approach, relative income distribution and the incidence of stress, which suggest that outcomes for those single pensioners living by themselves are somewhat lower than those reported by couples.

2.1.8 Maintaining adequacy over time

In addition to the level at which payments are struck, the basis on which they are adjusted over time contributes to their adequacy.

The CPI's goal is to provide a broad measure of inflation in the household sector. As an aggregate measure, it records the impact of price changes on the total quantum of consumption across the sector6. As a general measure of price inflation, the CPI does not reflect the impact of costs for particular households and indeed is more heavily weighted by the consumption patterns of higher income households, who contribute the greater weighting of their purchases. As a result, where households have a different pattern of consumption to the average of the population, changes in the specific costs they encounter may not be appropriately reflected by the CPI. To overcome this, the ABS has developed a number of Analytical Living Cost Indexes which account for the specific purchases made by different household types7.

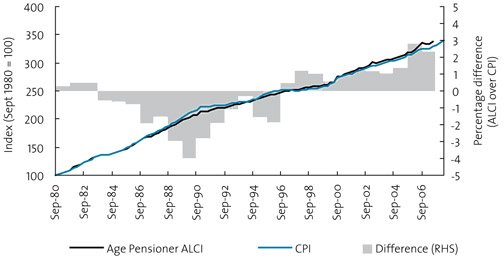

Chart 12 compares one of these analytical indexes—the Age Pensioners index—with the CPI, showing the trends in both measures of price increase and the difference between them.

Chart 12. CPI and Age Pension Analytical Living Cost Index

Over the 27 years for which the two indexes are available, the two measures of prices have varied at particular times. Over the whole period, the cumulative difference has been relatively small. The measure of prices for Age Pensioners has increased by 237.3 per cent compared with 229.5 per cent for the CPI. Over the past five years, while the CPI has increased by 14.5 per cent the price index for Age Pensioners has increased by 15.8 per cent.

In addition to the longer standing Age Pensioner Analytical Living Cost Index (ALCI), ABS has also developed more recent indexes for 'Other Government Transfer Recipient', 'Self-Funded Retiree' and 'Employee' households. Over the past five years, some ALCIs have increased more rapidly than both the CPI and the Age Pensioner ALCI. The Employee ALCI increased by 18.0 per cent and the Other Government Transfer Recipient ALCI increased by 16.6 per cent. The Self-Funded Retiree ALCI grew by 14.4 per cent over the period, which was less than the growth of the CPI and the Age Pensioner index.

If it were possible to further breakdown the Other Government Transfer Recipient group (something that is not currently able to be done because of the small sample size) it is likely that more specific subgroups of pensioners and allowees would have faced cost increases either above or below this average.

Of course, any measure of price change, whether it is the CPI, the Age Pensioner ALCI or any other measure, will not describe the actual price changes faced by a household. Such measures still assess price changes in an average basket of goods with average expenditure weights applied to the categories of items in the basket. There will always be a significant number of households with expenditure weights that mean they face higher or lower than average price changes over any time period.

Return to top Start of section

2.2 Frequency of payments, including the efficacy of lump sum versus ongoing support

Most Australian income support payments are paid on a fortnightly basis, reflecting the role of these payments in providing individuals and families with the money they need for their day-to-day living costs. However:

- some payments (for example, Telephone Allowance and Utilities Allowance) are made quarterly

- annual lump sums in the family payments system help moderate debts resulting from reconciling family income estimates with taxable income

- regular bonuses are intended to help with larger lump sum costs

- ad hoc bonuses have been paid annually to allow pensioners and some allowees to benefit from productivity gains in the economy as a whole.

Chapter 1 showed that different income support recipients get different packages of income support.

From the perspective of the individual pensioner or allowee, the frequency of payments and balance of lump sum and ongoing support are important because of how this affects the capacity to manage regular recurrent costs and less regular or unplanned lump sum costs. In addition to the quarterly and annual payments listed above, it should be noted that pensioners and allowees can get advances of their payments that they then repay. They can also use Centrepay to make regular payments to cover expenses such as utility bills and can use electronic banking to make direct payments from their accounts to help manage their finances.

Since annual and large quarterly payments are a relatively new component of the income support system, no research is available on customer preferences. However, information is available on people's access to cash reserves and/or credit that would allow people to meet planned and unplanned lumpy expenditure. This gives an insight into the need for mechanisms within the income support system to give people the flexibility to balance different types of expenditure.

2.2.1 Ability to raise funds in an emergency

Data is available on whether pensioners think that they have the ability to meet emergency needs. The 2003–04 Household Expenditure Survey asked households whether they could raise $2,000 in a week for an emergency. As the person's reliance on income support increases, their capacity to raise funds in an emergency decreases. Table 2 examines payment recipients by type of payment and proportion of household income that the payment constitutes, and the proportion of households that could not raise $2,000 in an emergency. For example, of all households relying on the Age Pension for 90 per cent or more of their income, 18.1 per cent said they could not raise $2,000 in an emergency. This increased to 50.9 per cent for the equivalent Disability Support Pension population.

| Proportion of household income derived from transfers | ||||

|---|---|---|---|---|

| Under 50 per cent | 50 to under 90 per cent | 90 per cent and over | Total | |

| Age | 6.1 | 2.3 | 18.1 | 11.4 |

| DSP | 15.2 | 18.4 | 50.9 | 35.2 |

| DVA | 3.5 | 4.3 | 8.2 | 5.5 |

| Parenting | 26.0 | 41.5 | 67.6 | 45.4 |

| Newstart/student | 20.7 | 38.2 | 45.4 | 31.3 |

| Other income support | 11.8 | 20.1 | 44.4 | 24.3 |

| All Households | 8.9 | 18.5 | 33.5 | 14.3 |

The main source households would use to raise funds in an emergency is private savings. Among Age Pension households highly reliant on income support who said they could raise $2,000 in an emergency, 68.8 per cent said they could do so from savings. For the comparable Disability Support Pension households, around half said they could access savings for this purpose.

2.2.2 Access to cash savings

Most income support reliant households have relatively few assets (although, as Chapter 3 describes, there are some comparatively wealthy households). This is even more marked when cash savings, which are an important source of liquid assets, are considered.

Most of the almost two million income support recipients living in households reliant upon transfers for more than 90 per cent of household income report they have savings under $1,000.

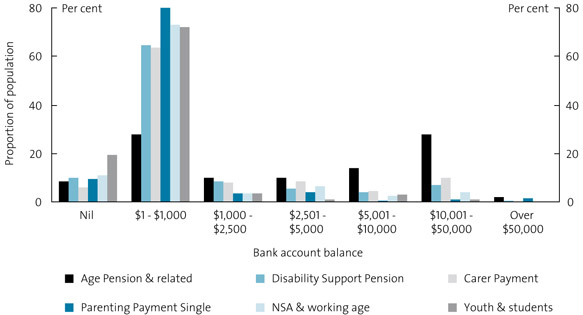

Amongst these highly welfare reliant households, Age Pensioners—along with those on DVA payments—have higher levels of savings and much lower proportions reporting very low savings (Chart 13).

Chart 13. Highly reliant income support recipients: value of bank accounts, 2005–06

2.2.3 Credit cards

The main form of non-housing consumer credit used by Australians is credit cards. The Reserve Bank of Australia reports there are some 12.9 million credit card accounts in Australia with balances of $39.3 billion.

Many consumers, however, do not hold a credit card either because they do not want to use one or because they have not been able to obtain one. This may be due to their credit history or because their circumstances are not considered by lending institutions to offer sufficient assurance of their ability to meet their obligations.

The majority of people on income support (52.7 per cent) who live in households mainly reliant upon transfers as their main source of income do not have a credit card. This proportion varies between types of income support and with the extent of reliance upon income support (Table 3). Overall, the more reliant a household is on income support the less likely people are to have a credit card.

| Proportion of household income derived from transfers | Total | ||||

|---|---|---|---|---|---|

| Under 10% | 10-<50% | 50-<90% | 90% and over | ||

| Age Pension and related | 9.2% | 27.1% | 40.8% | 56.6% | 45.4% |

| DSP | 14.7% | 29.6% | 39.5% | 68.0% | 50.6% |

| Carer Payment | 0.0% | 12.0% | 36.5% | 57.7% | 42.2% |

| Parenting Payment Single | 10.6% | 39.4% | 52.3% | 68.5% | 53.9% |

| NSA and working age | 16.5% | 33.6% | 43.3% | 50.5% | 40.7% |

| Austudy/Abstudy/YA | 8.4% | 29.6% | 52.3% | 65.8% | 34.5% |

| Other family payments | 13.5% | 21.7% | 51.1% | 52.5% | 19.4% |

| Other | 11.5% | 29.1% | 27.5% | 60.1% | 33.6% |

2.3 Structure and payment of concessions or other entitlements that would improve the financial circumstances and security of carers and older Australians

Chapter 1 reported that one principle of the social security system was to ensure that households in different circumstances achieve a comparable standard of living. This is an area where the income support system crucially depends on the wider social protection system; as is outlined below, this is particularly the case for those who face high costs because of disability.

One question in the design of social policy is whether the direct provision of services will meet an individual's needs more efficiently and effectively than cash transfers. Transfer payments work best when the costs of different groups are clustered tightly around the average. They tend to be based on an assessment of the average need of population groups (for example, renters, singles or couples). However, transfer payments work less well if used to address costs that are borne unevenly in the population. In this case there is a risk that groups with high needs will be significantly under compensated and groups with low needs will get a windfall gain.

2.3.1 Social assistance in kind

Australia's social protection system is designed to provide assistance as part of an integrated approach to people at key stages or events across the life course. In addition to income support payments and concessions on a range of goods and services such as those provided through the Pensioner Concession Card, Commonwealth Seniors Health Card and Health Care Card, the social protection system encompasses subsidised services such as child care, health, housing, transport, disability and aged care, compensation for work and other injuries, paid sick leave, and other cash and in-kind benefits. These contribute to the overall financial and economic security of pensioners.

Elements of the system are funded by all levels of government through transfers, tax expenditures and funding of community and welfare services. Business also contributes by providing employee benefits such as maternity and sick leave. The non-government sector also plays a role by providing services, as does the public (for example through compulsory levies on motor vehicles to cover compensation payments for road accident injuries).

Transfer payments operate in conjunction with these other forms of assistance to meet the needs of income support recipients. In a number of service areas, individuals may contribute to the overall cost of the service provided according to their ability to pay. Residential aged care services are a case in point. Here the government provides significant funding through the non-government sector's provision of aged care accommodation and services. The individual also contributes, either through paying a proportion of their pension or specified amounts based on their income and assets.

From the data available it appears that these services are well targeted. The ABS estimated in 2003–04 that 29.8 per cent of the gross value of this type of assistance flows to households in the lowest private income quintile (adjusted for household size).

It also appears that these services are a significant component of the total support available to low income households. Chart 14 shows, for those households that receive more than 90 per cent of their income from transfer payments, the value of net private income, transfers and non-cash benefits for households, classified by the main form of income support received by the household. In the case of households in receipt of the Age Pension, for example, the equivalised value of these benefits was $203 per week, which was close to the equivalised value of income support of $247 per week (in 2003-04).

Chart 14. Highly reliant households: components of final income, 2003–04

Both the level and mix of these non-cash benefits vary between the household types associated with these different payments. For example, while older income support reliant households have a very high use of health services, households with some income from the Disability Support Pension have a relatively high use of other welfare services, including disability services. These households, along with single parents, are high users of public housing. Because these data reflect average values of assistance across households, they disguise the much greater diversity in the benefit obtained by different households.

As the population ages, the need for additional health care in the community will increase. One of the most significant needs individuals may have over their lives is the need for, and access to, medical and health services. The timing and scale of the need for these services may be unpredictable for many. Australia, responds directly by providing a universal health safety net, which ensures all Australians can access health and medical assistance without being constrained by their ability to pay.

Another feature of an ageing population will be an increase in the number of people with disability who need access to services and support. Disability issues are central to this review as they cut across the income support population.

Return to top Start of section

2.3.2 Disability related services

Many people with disability have additional needs and associated costs related to their disability. The nature and level varies significantly from individual to individual. They are ameliorated, in part, by services funded by government that respond directly to a range of individual and household needs.

Costs

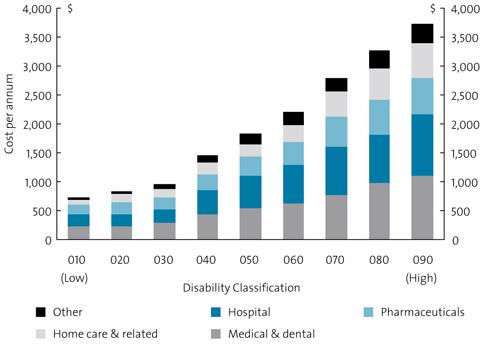

There is little systemic information available on the dispersion of the costs of disability. The DVA, however, has a unique data set drawn from its population of White Card holders, which provides information on service types by cost and by the level of disability of the card holder.

These data represent the average annual cost of the White Card at each point of the general rate disability pension under the Veterans' Entitlement Act. The White Card provides for treatment and other services for a veteran's accepted service-related disabilities.

Chart 15 illustrates the increases in cost by service type as the level of disability increases.

Chart 15. White Card clients: average expenditure, 2007–08

The data should be interpreted with some caution because they are the product of a complex eligibility system:

- they reflect only the costs of disabilities that have been accepted as being due to a veteran's service—that is, an individual could have more severe disabilities than implied by the level of their service-related accepted disabilities

- access to each program is regulated and capped through business rules, and further services beyond the caps can be approved on the basis of need

- the White Card population is concentrated in older age ranges

- costs are gross and do not include Medicare offsets.

The costs reflect a range of the total costs of disability and not the costs for individuals. These actual costs are much harder to identify and there is considerable debate surrounding them. A recent report undertaken for the United Kingdom's Department for Work and Pensions (Tibble 2005) reports that while research generally agrees on there being extra costs of disability that there is much variance in the findings of different studies of the cost to individuals with little agreement on the size of costs, the costs for specific groups and items, nor the factors that influence the size of costs.

2.3.3 Services example

Services for people with disability are provided through the current Commonwealth State Territory Disability Agreement (CSTDA), the Commonwealth Department of Health and Ageing's programs—including the Home and Community Care (HACC) program—and additional state and territory government funding. As an example of governments' contribution to the costs incurred by people with disability, the disability related services provided through the HACC program and the CSTDA are briefly described next.

Home and Community Care

The HACC program is a joint Australian, state and territory government cost-shared initiative, with around $1.6 billion in funding in 2007–08. State and territory governments manage the day-to-day administration of the program. HACC provides community care services to frail aged and younger people with disability and their carers to promote and enhance their independence at home and in the community. Types of services funded through HACC include nursing care, allied health care, meals and other food services, domestic assistance, personal care, home modification and maintenance, transport, respite care, counselling, support, information, advocacy and assessment. Information on the use of some of these services in 2006–07 is included in Table 4.

| Service type | Number of clients | Total service hours (million) |

Average per client (hours) |

|---|---|---|---|

| Centre-based day care | 74,227 | 8.70 | 117.3 |

| Respite | 34,642 | 2.46 | 71.1 |

| Personal care | 80,028 | 4.32 | 53.9 |

| Domestic assistance | 250,793 | 7.76 | 30.9 |

| Social support | 106,105 | 3.84 | 36.2 |

| Nursing care | 211,498 | 2.83 | 13.4 |

| Allied health | 163,110 | 0.88 | 5.4 |

The majority (92.2 per cent) of HACC clients in 2006–07 received some form of government pension or benefit, most commonly the Age Pension (65.2 per cent), Department of Veterans' Affairs pension (13.5 per cent) and the Disability Support Pension (8.8 per cent).

Commonwealth State Territory Disability Agreement

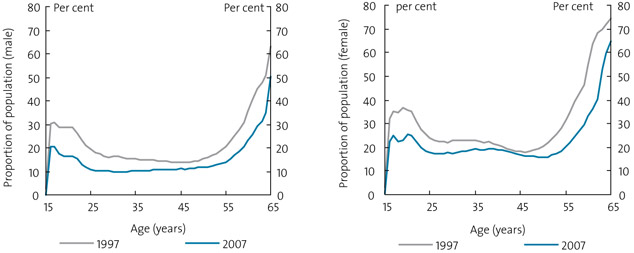

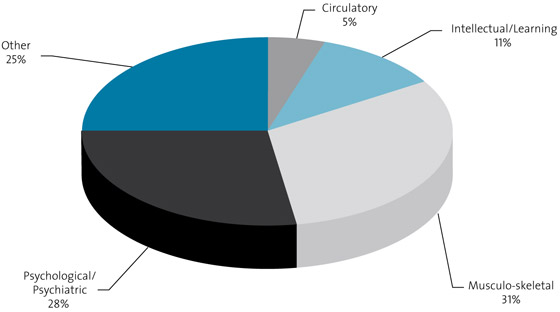

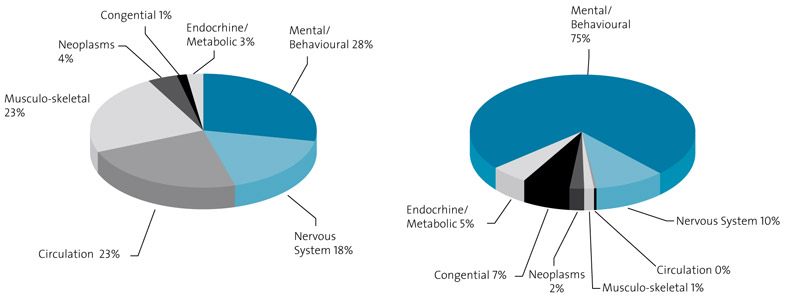

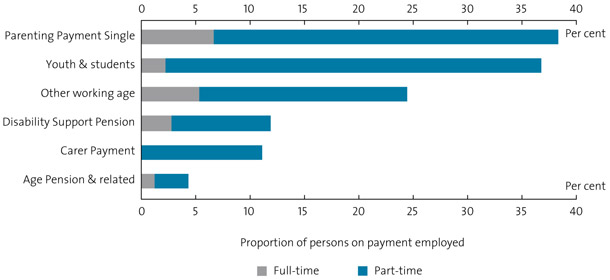

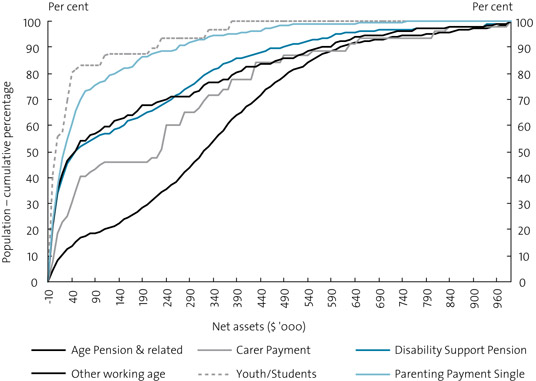

The CSTDA provides the national framework for the provision of government support to service for people with disability. Under the agreement, all parties are responsible for funding specialist disability services. The state and territory governments have responsibility for the planning, policy setting and management of accommodation support, community support, community access and respite care for people with disability. The Australian Government has similar responsibilities for specialised disability employment assistance.