Impact of the Economic Downturn on Corporate Community Investment

Attachments

Impact of the Economic Downturn on Corporate Community Investment

Executive summary

As a result of the financial downturn, many companies in Australia are experiencing significant pressure on budgets, including their budgets for corporate community investment.

However, not all companies are experiencing financial pressure. Correspondingly, their community investment approach and programs are unaffected. Even corporations that are under pressure to cut costs are looking for areas to find savings other than in community investment budgets.

Our research indicates that overall, companies are maintaining their commitments to corporate community investment.

Some corporations are adjusting their priorities and cutting back in areas such as sponsorships. However, for many of the largest companies in Australia, there continues to be a focus on strategic, long-term community investment.

An important context to note is that large publicly owned companies in Australia are going through the transformation to a more strategic approach to community investment, (as noted in the Centre's report on Corporate Community Investment in Australia (2007)).

These changes are characterised by a shift away from responding to ad hoc requests for worthy causes, to requiring some level of business case or return on investment justification, and choices of engagement that are closely aligned with business issues and specific corporate competencies.

Companies are moving to fewer, deeper relationships, which enable better leveraging and assessment of benefits and more sustainable, longer term relationships with explicit mutual obligations. These relationships are underpinned by identified key performance indicators.

These trends are not yet typical among small and medium enterprises (SMEs), private companies, or 'closely held' public companies, a fact that may not make this study typical of companies as a whole.

There is also a trend in major companies to expand long-term community investment to meet employee and community expectations and enhance reputation.

A number of companies have cited relatively new and high-level corporate commitment to longer-term community investment as a protection against deep cuts in the current economic downturn.

In general, companies are anxious to avoid reputational damage and risks to trust with partners and communities by reducing community investment support in an environment of greater community need. Nevertheless, while there is an increase in demand for support from community organisations, we found that most companies are reluctant to engage in new relationships or expand existing activities.

A focus on strategic, long-term community investment activities

Companies consulted for this research say they are maintaining their focus on strategic, longer-term community investment. Three-quarters of the participants in our survey report that the rationale or motives for undertaking community investment remains the same, even during an economic downturn. Motives such as community trust/support, reputation and employee engagement continue to be the most important drivers of corporate community investment strategy and activity.

Companies are continuing to focus on alignment of community investment activities and programs with corporate strategy, despite the downturn. The Centre's 2007 research highlighted this trend. The economic downturn has not changed this, and if anything, has confirmed this approach, as more companies look to ensure alignment to justify the value of their community investment.

Business practitioners report that they are spending more time providing justification of the value to their company from resources spent on community investment.

This in turn means that NFP partners are being asked more frequently to justify the benefits of community investment and provide more information to their corporate partners. As one business practitioner commented, 'Every decision is looked at even more closely for strategic alignment to the corporate strategy and vision'.

Companies are honouring longer-term commitments

Companies that have multi-year contracts or long-term commitments are honouring those agreements.

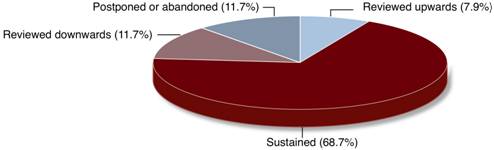

According to our survey respondents, 69 per cent of companies are sustaining their multi-year commitments, while 12 per cent report they have been reviewed downwards. Another 12 per cent say their commitments have been postponed or abandoned.

We note that respondent companies allocate (on average) 52 per cent of their corporate community investment budget to multi-year strategic partnerships.

Some companies most severely hit by the downturn (notably some US-based multinationals subject to global cost saving mandates) have been forced to cut their community investment contributions, and some companies are re-negotiating to push some of their commitments into later years when they assume more normal conditions.

While existing commitments tend to be honoured, NFP partners and corporate champions of community investment are concerned about the position budgets will be in when agreements are rolled over in coming years.

Some companies also report a move away from longer-term commitments. Against the trend, these companies are responding to more urgent needs from NFP organisations and re-focusing some of their community investment activities towards more immediate community needs flowing from the economic downturn.

Managing community investment budgets

In 2008/09 compared to the previous year, 41 per cent of respondents to our survey indicated that their overall community investment budget had increased. Thirty-five per cent reported no change. Most (55 per cent) expect no change to their budget in 2009-2010, while 26 per cent anticipate an overall increase. Nineteen percent forecast a decrease.

One theme that emerged strongly from our research is a consequence of the propensity of some companies to respond to financial pressure by announcing flat percentage cuts to costs in business departments across the board. So far, in public affairs departments that administer corporate community investment programs, hits are being taken in rearranging priorities, head count and overhead costs rather than in contributions to community investment.

While some companies report some diversion of resources from NFP partners because of recent natural disasters, this has had only a modest effect. This is because disaster relief tends to be budgeted separately from ongoing community investment resources.

Change in approaches to corporate community investment and nature of support

According to our research, companies expect no major change in the direction of corporate investment contributions in 2009-2010. Focus groups for this report reveal, however, there could be some diversion of support from what may be perceived as less urgent activities (or for the sake of 'optics'), such as arts and culture activities or sponsorships that are aimed at corporate branding, or community investment that could be considered as indulgent.

A recent arts sponsorship survey by the Australian Business Arts Foundation (2009) highlights that nearly half of surveyed companies expect a decrease in their arts sponsorships over the next year. The report suggested that sponsorship was more vulnerable if the motives were hospitality or senior management personal interests, rather than strategic alignment to the company (AbaF 2009).

For some companies reductions in these areas can result in savings to corporate budgets (especially marketing budgets) or some diversions to welfare activities or local community needs. At the same time, some companies see benefit in associating themselves and their products with community needs via cause-related marketing including, funds tied to product sales.

Our research finds no major change in levels of corporate support for different areas of community investment - including community activities, non-marketing sponsorships, workplace giving and payroll deductions, research partnerships and corporate volunteers. As noted earlier, some companies are reducing support in areas such as marketing-related sponsorship and untied cash.

Corporate volunteering continues to expand, including to retain an under-employed but valued workforce. Sixty-eight per cent of respondents to our survey expect an increase in corporate volunteer support in the next year, while 52 per cent expect an increase in workplace giving and payroll deductions. This is consistent with the finding that companies are increasing their resources on programs that engage employees.

Some companies also report a shift from cash to in-kind contributions. We expect this will increase in the next year as companies face further economic pressures and look for alternative ways to continue their support.

Managing relationships with NFP partners

As noted above, corporate public affairs departments, that have responsibility for administering community investment programs, are making changes to head count, priorities and other overhead costs rather than making cuts to corporate community investment budgets. This is negatively impacting the company's ability to manage its community relationships.

At a time when community investment is being recognised for its positive contribution to business and community objectives, these challenges relating to the management of NFP partnerships threaten to have important long-term consequences.

Corporate employees report that while there is a need for communication with partners as a consequence of economic pressures, they have less time and money to stay close to them. They also have less time to leverage contributions for their companies' benefit and hence demonstrate return on investment value. Concerns are that this could lead to a return to arms length 'cheque over the fence' philanthropy that deflects from the positive trends under way.

Despite this, companies report that communication, trust and understanding remain strong with their NFP partners. Sixty-three per cent of survey respondents agree there is more communication with their NFP partners, while 60 per cent say they are working closely to manage uncertainties.

This study concludes that relationships with NFP organisations are more likely to be sustainable if they are based on longer-term, strategic alignment with company strategy.

Sustainable relationships are also likely to involve regular contact, good communication, and include regular measurement and reporting of outcomes.

We note that many of the characteristics of sustainable relationships will benefit larger NFP organisations in particular. In this environment it would be difficult for smaller or less sophisticated NFP organisations to win corporate support if they cannot satisfy accountability demands, or if they are in community areas or sectors that are less attractive for companies who are seeking specific alignment with corporate strategy.

Chapter 1 Introduction

1.1 Background to project

The Department of Families, Housing, Community Services and Indigenous Affairs commissioned the Centre for Corporate Public Affairs to undertake research into the impact of the current economic downturn (2008-2009) on corporate community investment.

This follows three major Centre research projects on corporate community investment and community business partnerships in Australia (Corporate Community Involvement: Establishing a Business Case 2000; Corporate Community Investment in Australia 2007; Relationship Matters: not-for-profit community organisations and corporate community investment 2008).

1.2 Project objectives

Our analysis focuses on how the economic downturn has impacted, or is likely to impact, corporate approaches to community investment, including relationships with not-for-profit (NFP) organisations.

This includes the nature and quantum of community investment budgets, the nature of support (cash, in-kind, volunteering, cause related marketing, brand related sponsorships), and whether or not shifts are taking place in the nature of support.

We also seek to better understand the characteristics in business and not-for-profit relationships that facilitate sustainability of programs through the business cycle.

1.3 Methodology

The study incorporates research from two sources - an online survey of 150 leading Australian listed companies, and small focus groups of senior public affairs/corporate affairs practitioners responsible for corporate community investment strategy, execution and NFP relationships.

Online survey

The Centre developed and managed an online survey of 150 leading companies in Australia. The survey responses were from senior public affairs/corporate affairs executives and executives responsible for corporate community investment in their companies. The online survey was open between 20 May and 12 June 2009, and generated 70 responses.

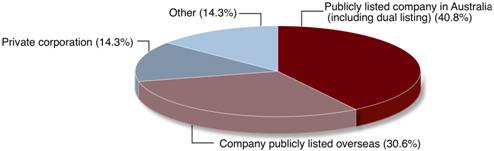

The provision of demographic information from the respondents was not required. Of the 49 companies that chose to supply demographic information, 41 per cent are publicly listed companies in Australia, and 31 per cent are publicly listed overseas (see Figure 1.1 ). The majority of these companies (96 per cent) employ more than 200 employees. The remaining 4 per cent employ between 21 and 200 employees.

Figure 1.1:Survey Participant Company Classification

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=49

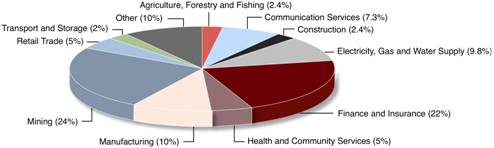

Twenty-five per cent of the companies that provided industry classification are involved in mining, and 22 per cent in financial services (see Figure 1.2 ).

Figure 1.2:Survey Participant Industry Classification

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=41

Consultations with business executives

The Centre for Corporate Public Affairs convened small participant focus groups in Sydney, Melbourne, and Perth and conducted additional interviews with senior executives. Thirty-six business executives participated in these discussions and interviews.

The discussions and insights from the focus groups and interviews are reported and cited in this study.

Chapter 2 Corporate community investment decision-making

This chapter provides a snapshot of the feedback we received from our online survey, focus groups and interviews relating to decision-making on community investment in the larger corporate sector.

We note changes to motives, strategy, and agreements with not-for-profit (NFP) organisations, as well as implications on future prospects of new partnerships, influenced by the economic downturn.

Our survey and focus groups reveal that corporate behaviour varies in response to the economic downturn. Most companies still focus on strategic, long-term activities. Some are adjusting priorities to deal with more immediate problems, and are avoiding activity that might be considered 'indulgent' in the current circumstances.

We note that the extent and direction of this change in approach depends on the degree to which companies are financially affected by the economic downturn, and 'the optics' (perceptions) of activities when, for example employee retrenchments are being made.

We note a distinction between companies that have American ties or are allocated budgets from the United States, and those that are Australia-based.

US-based companies are more likely to experience drastic cuts in their budgets and depart from, renegotiate, or not renew, existing corporate community investment commitments.

Companies and not-for-profit organisations report much more significant consequences for community investment in the US and the UK than in Australia.

There are other significant, and subtle, consequences of economic pressures on corporate community investment, including a shift from cash to in-kind support, and implications for volunteering. These will be discussed in some detail later in this report.

2.1 Rationale and motives for corporate community investment

Our Corporate Community Investment in Australia report (2007) confirmed a long-term shift in the focus in the large corporate sector from arms-length, charity oriented 'philanthropy' characterised by ad-hoc responses to requests concerning worthy causes, to more strategic, business case-based community investment.

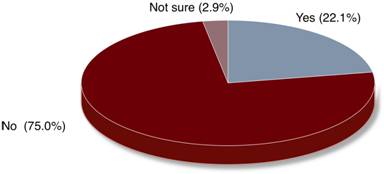

The majority of companies in focus groups for this report note no change in their rationale for community investments as a result of the economic downturn (see Figure 2.1

Most respondents to our online survey also suggested continuity in motivation, indicating no change between what they currently seek from community investment and what they expect they will seek in the next year.

Figure 2.1 :Has there been change in the rationale or motives for undertaking community investment/corporate giving as a result of the economic downturn?

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=68

Sixty-two per cent of companies in 2009 require or assume a focused business case when expending resources for corporate community investment.

Forty-one per cent currently seek a generalised benefit. Responding to a separate question, most companies in our survey indicated there has been no change in the expectations they have for a business case to justify their corporate community investment, and that this will be the case for 2009-2010 also.

Three companies in the survey noted that they expect a move from a broad business case to specific metrics on return on investment (ROI) for the next year, suggesting a move towards a stronger financial justification for their community investment.

However, stronger evidence emerged during interviews and focus groups that companies in tighter economic circumstances were focusing even more on value for money in all areas of expenditure, requiring more tangible evidence of value created for the company and the community. As one participant notes:

We now have to assess our decisions based on their impact more broadly to the company.

As a consequence, companies are asking their not-for-profit partners (as well as front line company practitioners in the area), to demonstrate the benefits - and not just the short-term value - of community investment, and more generally, of their relationships with NFP organisations.

Concurrently, as explored in more detail later, companies are receiving more urgent calls for assistance from the NFP sector, and want to be seen to be responding to heightened community need during economic hard times.

Against the trend, some companies are responding by shifting activities from longer-term goals, and less tangible benefits (such as sponsorship), to meet immediate needs in the community.

One survey respondent notes:

While we have previously adhered to a strict strategic business case model of community investment in the past, we are now considering our options to retain this, but move beyond this mechanism to consider the public good, and engaging stakeholders emotionally.

Several online survey participants indicated they have made special one-off grants to meet specific needs (for example financial literacy for clients in difficulty, neighbourhood housing in decentralised areas) or shifted priorities within their funding envelopes to areas of need such as food aid.

Others also note an increase in staff efforts through matched giving programs, which has led (together with internal funding pressures) to companies putting caps on company matched contributions, where they had not existed previously.

Some companies note that changes in strategy and the direction of the public affairs function are part of overall strategic changes in the organisation. These changes may be impacted, but are not principally related to the current economic downturn.

We are going through a general internal change - decision-making is progressively shifting towards local branch managers, and this is also affecting the way public affairs works. Community investment has gone up, and we don't need to rationalise much for it, because the company understands this is important for employee engagement.

We have a new CEO who has a fundamentally different approach to what we should be doing, and everything is being reviewed.

Table 2.1 presents some online survey comments from companies that retained or altered their motives and rationales as a result of the economic downturn.

| No | Yes |

|---|---|

|

|

Source: Centre for Corporate Public Affairs, Survey of business executives 2009.

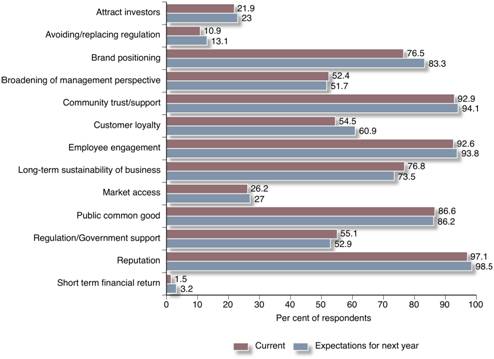

Respondent companies rate community trust/support, reputation and employee engagement as the most important motives for undertaking community investment programs and activities.

Figure 2.2 demonstrates that these motives remain very important in corporate expectations for next year. This Figure also demonstrates that none of the motives is expected to be significantly less or more important in the next financial year.

Employee engagement continues to be a significant motive for corporate community investment, regardless of the economic downturn, as indicated in this comment from one focus group participant:

We are using partnerships more as an employee engagement mechanism - this hasn't changed.

Figure 2.2: Relative Importance of Motives for Undertaking Community Investment Programs and Activities (Very Important and Important)

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=70, Note: The graph depicts the percentage of respondents that answered 'Important' and 'Very Important'.

These survey results, as well as the discussion in our focus groups, reveal little shift from the range and salience of motivations for corporate community investment from the study undertaken in 2006.

2.2 Aligning corporate community investment with corporate strategy

Most respondent companies (67 per cent) in our survey disagree that the economic downturn has impacted the degree of alignment between community investment and business interests. For them, there has been no change in this degree of this alignment, because it is already well established as best practice in their corporate community investment programs.

As one participant at the focus groups notes:

Our community investment has for a number of years been required to be aligned with our strategy, and be able to demonstrate genuine value across numerous levels.

One in three companies have increased the alignment of their community investment and corporate strategy to respond to financial pressures. One focus group participant stated:

Each decision is looked at even more closely for strategic alignment to the corporate strategy and vision, and the current portfolio is likely to remain static rather than growing in the next 12 months.

Another said:

We are cutting back on anything that might be superfluous, and tightening our definition of what is important to us and to our stakeholders.

Table 2.2 presents commentary from companies that altered or retained the degree of alignment between community investment and business attributes and interests

| Yes | No |

|---|---|

|

|

Source: Centre for Corporate Public Affairs, Survey of business executives 2009.

2.3 Reviewing agreements

Companies differ on whether they are revisiting long-term understandings and agreements with their community partners. Forty-nine per cent of survey respondents agree that they are, and 38 per cent disagree.

Participants in the focus group note that in some cases, multi-year commitments are reviewed in line with business strategy, and not the current economic situation. They also note that, in some cases, short-term agreements are more appropriate to respond to pressing community needs during the downturn, as illustrated by the following comments:

A recent review of sponsorships showed that we were not gaining a lot from the relationships. Those partnerships are now being reviewed to ensure branding and leveraging opportunities are maximised, and the partnership is much more closely aligned with the corporate strategy.

I presented to the Board late last year a renewal proposal for our partnerships and they all got approved. I wanted to continue the momentum that was building up these past years. We demonstrated clearly the value that these partnerships bring to the company, and also the value in maintaining these partnerships in the long run.

We are actually concentrating more on short-term achievements, because there is more need for immediate action and help. We are committed to skills building and the current economic situation has created immediate demand for support to unemployed people. We are faced with new priorities and this has made us change our direction. This means we are also looking for new NFP partners. We are placing the power light on these new priorities and relationships, but we are still keeping the flame on our old partnerships. We are not sure whether these new partnerships will be long-term, because they are mostly based on the period of the emergency.

Even where they are reviewing arrangements, most respondent companies are committed to sustaining their multi-year commitments (69 per cent) with only a few reviewing them upwards or downwards due to the economic downturn (see Figure 2.3 ).

While reviews are taking place, almost all companies (94 per cent) claim they are honouring their contracts with NFP community partners.

Figure 2.3:Have multi-year commitments been sustained or reviewed as a result of the economic downturn?

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=44.

Discussions with companies in our focus groups suggest that while they are acknowledging increased demand for services to the community, they are still hard pressed to maintain existing commitments, and are tending not to increase them.

Some companies that are hardest hit (especially those at the end of global corporate mandates from the US or Europe), have cut significantly.

Others that are also significantly impacted have approached partners to re-negotiate, or shift commitments out by a year or two. Commonly, companies are reporting their NFP partners have anticipated this, and have budgeted accordingly.

While there has been some renegotiation of commitments where economic pressures on companies have hit hard, there appears to be a determination among most to honour existing contracts, which are typically for three years, and to review them at the contracted period of review and rollover.

Accordingly, about one third will be due for rollover in any year. It appears that NFPs that have achieved rollover early in the down cycle have done well (as indicated in a previous comment). But both NFPs and their champions within companies are apprehensive in relation to those still to come.

In these circumstances, companies indicated their priority is to maintain relationships with existing partners, even if it has to be at a lower level of support. And they are reluctant to consider proposals from new potential partners (as we will see in section 2.5).

Even within existing arrangements, there is strong evidence in the qualitative and quantitative research that partnerships are being reviewed carefully to evaluate social outcomes, as well as business case considerations.

In addition to the economic downturn, surveyed companies reported that other factors were influencing simultaneously some of their community investment decisions.

The desire not to appear 'extravagant' was causing community investment arms of businesses to 'tone down' spending or communication. Some businesses reported general repositioning of their brands, which was having an impact on community investment patterns.

There has been a long-term shift in companies in Australia and overseas to refocus corporate community investment spending from being directed overwhelmingly from head office country, to distribution to overseas host environments, weighted to the degree of business activity there. Some businesses noted there was more emphasis on growth markets in Asia, resulting in scaling back of investments in Australia and New Zealand.

Others noted that some partnerships are not performing as expected, and in an environment focusing on tighter accountability, decisions to withdraw may have been exacerbated because of the downturn - but were likely to be made in due course anyway.

2.4 Communicating community investment

Figure 2.2 illustrates that reputation is one of the most important motives for a corporation undertaking community investment activities. Companies have traditionally been communicating their corporate community investment to ensure that their stakeholders understand their efforts as part of building good reputation.

This is done in a variety of ways, but includes reporting via corporate websites, some advertising, and in a variety of publications and reports.

Interviews and focus group comments for this report indicated that some companies are planning to take advantage of the perceived community interest in meeting social needs during the downturn to lift the profile of what they are doing, and hence attract more attention to what they perceive to be inadequate exposure of their community activities.

For several companies, spending on communications will be maintained or in one case, enhanced as part of a longer-term strategy to demonstrate community investment as an increased element in core business strategy.

The general cuts in corporate overhead, now and anticipated in coming budgets, will nevertheless put pressure on communication budgets, with priority going to maintaining current commitments and direct support.

Table 2.3 presents commentary from companies that maintained or altered their community investment communication efforts. Companies that note a change in communication identify both an increase or decrease in their efforts, either because they see an opportunity to better engage stakeholders, or need to manage budget cuts.

| Yes | No |

|---|---|

|

|

Source: Centre for Corporate Public Affairs, Survey of business executives 2009.

2.5 Future prospects for community partnerships

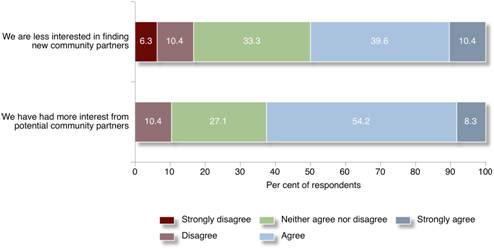

Companies are generally expecting to maintain long-term partnerships, albeit in a number of cases at a lower level as agreements roll over. It is of concern to note, however, that companies participating in the survey are less willing or able to consider new community partners.

There is a longer-term trend for companies to pursue deeper relationships with fewer NFP partners. In normal circumstances this makes it more difficult for community organisations that wish to pursue relationships with corporations that are outside existing relationships.

However, it is clear from qualitative and quantitative data that this is more difficult now, and will be more difficult in the near future, because of pressure on corporate budgets.

Half of the respondent companies are resisting the development of relations with new partners, despite the majority of companies agreeing (63 per cent) that they have had more interest from potential community partners (see Figure 2.4 ).

Figure 2.4:statements on future potential partnerships

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N= 48

Participants in the focus groups agreed that the NFP sector is desperate for assistance, due to increased demand for services relating to the economic downturn, and because of strain on resources.

Companies are reporting substantially greater levels of requests from NFP organisations to support worthy activities. Many of these requests are in the welfare realm.

Notwithstanding these pressures, many companies are not in a position to respond to these needs. The reasons for this include the following:

We are seeing an increase in requests for support, and more desperation in these requests.

We have seen a 50% increase through client representatives from people or organisations asking for support. Because we have no additional funding, we have to say no to these requests.

The GFC will have an impact in terms of the level of sophistication of partnerships and impact on development of new ones. Less likely to look to expand new ones because of the overhead costs associated with this.

No new multi-year partnerships were entered into this year and the same will occur next year; existing multi-year partnerships are continuing to be supported.

Also, as a result of the economic downturn, some companies are more interested in the sustainability (long-term viability) of their NFP partners.

As a direct result of these pressures, and concerns about the health of NFP organisations, a few companies reported an interest in seeking alliances with new partners from the corporate sector, accompanied by a new approach to co-branding and collaborating in activities.

Box 2.1 presents some further comments from survey participants on the prospects of future partnerships, highlighting mostly their unwillingness to move into new partnerships.

Box 2.1

How has the economic downturn impacted on relationships with potential partners?

We say no more frequently and more quickly.

It is unlikely that we would take on any more partners at this time as our budget is fully committed.

We are unable to move forward on potential partnerships however we tend to have an existing partnership with the majority of stakeholders interested in this avenue.

Not much scope for new partnerships.

No new corporate partnerships or programs.

We talk to less 'potential' partners.

I think it is less about the economic downturn and more about a move to more strategic, lasting partnerships.

In establishing new relationships, we will look to ensure the NFP is in a strong position to withstand the GFC and the consequences it may have on their operations.

Less opportunity to explore new programs/partnerships because of expected flatline or decreased budgets.

We are not seeking new partners.

I suspect it is very unlikely that we would bring on new community partners at this time. Much more likely to work to consolidate our existing ones.

We are more inclined to seek out partners that are able to deliver to a specific brief with agreed outcomes, and less likely to engage in discussions resulting from unsolicited approaches.

Source: Centre for Corporate Public Affairs, Survey of business executives 2009.

Chapter 3 Approaches to corporate community investment

This chapter provides a snapshot of the feedback we received from our online survey and focus groups relating to how companies are approaching corporate community investment, and making decisions on how to allocate their budgets. It also examines what activities and modes of delivery to choose.

We specifically note any changes to employee volunteering and giving resulting from the economic downturn.

3.1 Allocation of budget

Overview

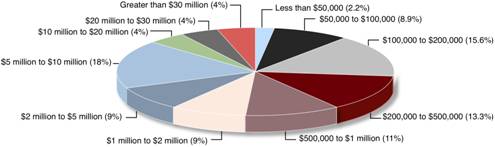

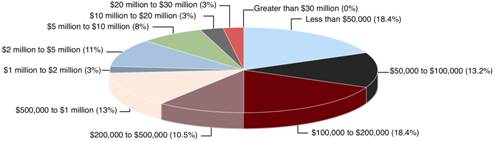

Respondents to the online survey anchoring this report represented companies with a wide range of overall annual community investment contributions, both cash and in-kind. Figure 3.1 illustrates the percentages of companies allocating cash and in-kind contribution at each investment level.

Figure 3.1:Participant Companies' Overall Annual Community Investment Contribution

CASH (N=45)

IN-KIND (N=38)

Source: Centre for Corporate Public Affairs, Survey of business executives 2009.

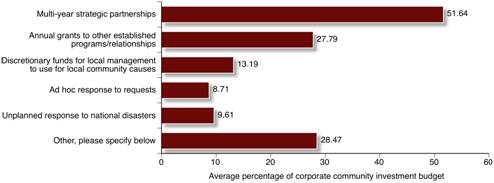

Respondent companies allocate on average 52 per cent of their corporate community investment budget on multi-year strategic partnerships, 28 per cent in annual grants, and 13 per cent on local funds for managers to use (see Figure 3.2 ).

Seventeen per cent is allocated to ad hoc requests and funds for emergency disaster relief. In addition to these categories, 28 per cent of respondents noted they allocate funds to 'other' areas including the cost of staff volunteering, workplace giving matching, and cause and issues 'awareness days'.

Figure 3.2:Corporate Giving/Community Investment Budget Allocation

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=52, 'Other' includes workplace giving matching, and employee volunteering.

Changes in community investment budgets

Companies surveyed were asked about budgets for 2008-2009 and for the next financial year.

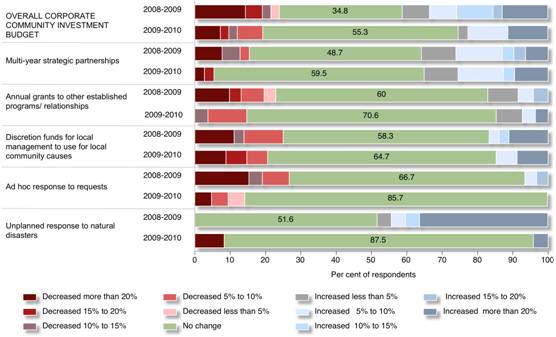

Forty-one per cent of the participant companies note that their overall corporate community investment budget had increased between financial years 2007-2008 and 2008-2009.

One third of these companies report budget increases of more than 20 per cent, and 25 per cent report an increase between 10 and 15 per cent.

Thirty-five per cent note that their overall corporate community investment has not changed. Twenty-four per cent of companies note their overall corporate community investment budget has decreased. More than half of companies experiencing a cut have had their budget decrease by more than 20 per cent (see Figure 3.3 ).

Figure 3.3: Change in Budget for Corporate Giving/Community Investment Due to Economic Downturn

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=49 Note: The graph demonstrates the level of increase or decrease in the budgets for financial years 2008/09 and 2009/10.

As Figure 3.3 demonstrates, most companies predict that there will be no change in the level of overall corporate community investment next financial year.

Fifty-five per cent of companies are not expecting any changes in their total corporate community investment budget over this period. More companies expect a total increase (26 per cent) than a decrease (19 per cent). A significant number also anticipate there will be no change to multi-year strategic partnerships, annual grants, discretionary funds and other ad hoc or unplanned responses to requests.

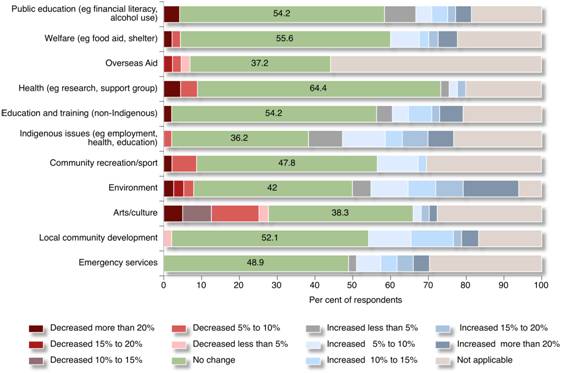

The majority of companies predict that there will be no change in the direction of corporate investment contributions in the coming year. Sectors where respondents anticipate an increase are indigenous issues (an increase for 38 per cent of companies) and the environment (an increase for 44 per cent). Twenty-eight per cent of companies anticipate a decrease in their spending in arts/culture programs (see Figure 3.4 ).

Figure 3.4:Expected Change In Direction of Corporate Community Investment Contributions

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=51 Note: The graph demonstrates the level of expected increase or decrease in the budgets for financial year 2009/10.

Most focus group participants report cuts in their public affairs budgets of around 10 to 20 per cent. For some participants, discretionary spending has been cut significantly, as indicated in this comment:

It's a different environment now for art events and formal dinners. There's less and less of that.

As noted elsewhere in this report, the cuts have been targeted at administrative overhead, including general communication spending. However, so far large companies have been trying to sustain their community investment spending. A significant number of survey respondents (41 per cent) reported their community investment budget had increased in the last financial year.

We've cut out a lot of business brand sponsorships, but the philanthropic sponsorships haven't been affected. We are cutting most entertainment and travel costs. Our CEO now flies economy.

This survey data is reinforced strongly by focus groups findings and its conclusions strengthened considerably by the findings of the 'Arts Sponsorship Outlook Survey 2009' by the Australian Business Arts Foundation (AbaF).

The AbaF study found that 49 per cent of companies expected to decrease arts sponsorship over the next 12 months, and companies contributing most per annum (over $500,000) were more likely to reduce their spending.

The sharpest decline is expected to occur in the final quarter of 2009 and the first quarter on 2010. However, more than two-thirds of businesses are committed to maintaining their arts partnerships over the long term.

In the current circumstances, it is no surprise that marketing-related sponsorships, such as the arts and sport and accompanying corporate entertainment, and indeed any conspicuous consumption, is in decline when shareholder value is declining and staff are being retrenched.

The AbaF survey also confirms our analysis that companies are seeking more value by positioning and closely managing these sorts of sponsorships in the current circumstances. Despite this, only 11 per cent of participants were satisfied with their ability to measure return on their investment.

The AbaF survey also supports our research here and in previous reports, highlighting that:

...partnerships are more vulnerable to being reduced or cut when they are based not on long-term strategic alignment (including CSR), brand or staff objectives but on short-term tactical considerations, especially where motivating factors include hospitality benefits and personal interests of management.

AbaF, Arts Sponsorship Outlook Survey 2009, Summary of findings and recommendations, May 2009

Disaster relief

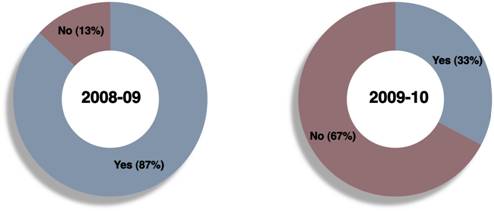

Another factor influencing corporate community investment budgets is the spike in corporate responses to natural disasters in 2008-2009. Eighty-seven per cent of survey respondents said they had made (or were committed to) a significant contribution to disaster relief in the financial year 2008-2009.

A smaller proportion is committed to a significant contribution to disaster relief in the following financial year (only 33 per cent, see Figure 3.5 ).

This low proportion can be attributed to the common practice, noted below, to fund disaster relief in an ad hoc manner as need arises, and outside normal community investment budgets.

Figure 3.5:Have you made (or are commiTted to) a significant disaster relief contribution?

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=54 & 49.

Of companies that contributed to disaster relief in the 2008-2009 financial year, 87 per cent note that their disaster relief contribution was made from ad hoc contingency reserves, with only 13 per cent having diverted funds from existing or corporate giving/community investment budgets for disaster relief commitments.

Some businesses note that they allocate a notional amount for disaster relief annually, so that in the event of a disaster they can respond immediately. This circumvents approval processes, and ensures no other partnerships are compromised by diverting funding.

3.2 Selection of activities and modes of delivery

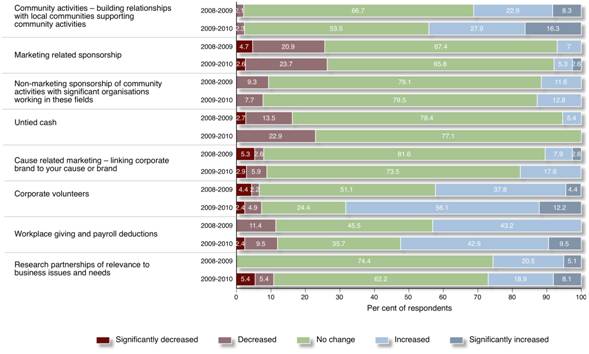

Most companies are not experiencing changes in their level of support for different community investment activity (see Figure 3.6 ).

However, areas of activity or modes of delivery that are being affected are those expected to be affected also in 2009-2010.

The most significant increase relates to corporate volunteers (increase for 42 per cent of participating companies) and workplace giving and payroll deductions (increase for 43 per cent of participants).

More companies are expecting more focus on these activities in 2009-2010 - 68 per cent of companies expect an increase for corporate volunteers, and 52 per cent an increase in workplace giving and payroll deductions.

Figure 3.6: Change in Level of Support in Areas

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=50 Note: The graph demonstrates the level of increase or decrease in the level of support for financial years 2008/09 and 2009/10.

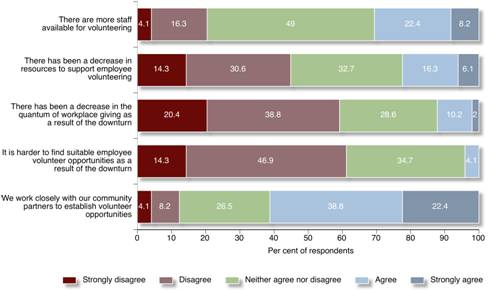

The majority of respondent companies in our online survey do not believe the economic downturn has influenced employee volunteering in a negative manner (see Figure 3.7 ).

Figure 3.7:Statements on Volunteering

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=49.

The small number of companies that have seen some negative impact on corporate volunteering note that it has been affected by staff cuts. As one survey respondent notes:

There are less staff for volunteering because simply there are less staff and people have the same if not more work to do.

Despite this, the picture for corporate volunteering remains bright. Almost one in three companies agree that they have more staff available for volunteering. This suggests an opportunity for corporations to seek further involvement with community partners in this area of support. Indeed, 61 per cent of companies agree that they are working closely with their community partners to establish volunteer opportunities. A number of innovative approaches to volunteering are being employed, or explored, which may have implications for volunteering when circumstances return to normal.

Interviews and focus group discussions confirm that corporate volunteering is a deliberate part of strategy to demonstrate social commitment to employees, and involve them in efforts to position the corporation as an 'employer of choice'.

As Figure 3.6 demonstrates, local community activities are also a sphere that is currently experiencing an increase in investment (31 per cent of companies). This is expected to continue to increase in 2009-2010. For 16 per cent of participants, this increase will be significant.

Our qualitative analysis suggests this is a natural consequence of the downturn, as companies respond to local needs, particularly in communities with dependence on a company or where the company has a high profile. In addition, companies frequently seek to do more in communities suffering because of lower demands in local products or where there is under-employment.

One in four survey participants say marketing-related sponsorships have decreased (Figure 3.6 ). This is consistent with our earlier discussions about levels of corporate support for arts sponsorships.

Sixteen per cent of companies note a decrease in untied cash donations. This is part of a general trend for companies to move away from traditional philanthropy and more to integrated partnerships but has been exacerbated also by economic pressures leading to tighter stewardship and accountability for corporate contributions.

Funds for marketing-related sponsorships and untied cash are expected to decrease further in the 2009-2010.

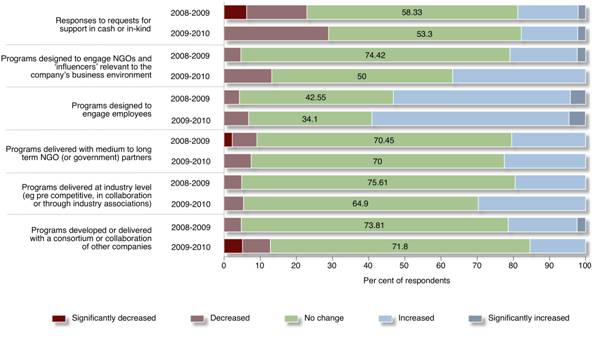

There is considerable variation in the responses to the survey relating to how companies currently respond to requests for support in cash or in-kind support.

There are almost as many companies experiencing an increase in requests for cash or in-kind resources as companies that are experiencing decrease in requests (see Figure 3.8 ).

Figure 3.8:Change in Modes of Delivery

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=49. Note: The graph demonstrates the level of increase or decrease in the proportion of resources used for financial years 2008/09 and 2009/10.

Focus group participants and interviewees reported they are moving towards providing in-kind rather than monetary support:

There's more opportunities for in-kind support now. We are happy to provide in-kind support.

Our program is still growing, however there's great shift towards in-kind.

Many companies report that more value can be created by the supply of goods and services, than by the provision of cash to purchase these at a later (and potentially) more expensive stage. Companies can, and some do, cite the value of their contributions at retail cost.

This shift from corporate monetary to in-kind support is expected to increase as more companies face further economic pressures and look for alternative ways to continue their support. It is also part of a longer-term trend, and the downturn could have the effect of quickening the pace of this development.

Noting short-term trends in arts sponsorship, the AbaF study concluded:

One half of businesses are likely to substitute some monetary support with the provision of in-kind services or products instead.

It is also important to note that the view of the CEO is a critical factor in the direction of approaches to external relations and community investment, regardless of the economic environment.

With an average tenure of four years in major companies, a number of companies have reported this has been a more important factor in changes to community investment than the economic downturn. Others also note that they have been on the journey to a new and more embedded approach along the trend line, including a closer alignment with business strategy and circumstances, described in the Centre's 2006 report and mentioned above. This too is a factor influencing the number reporting that changes are underway.

Matched giving and staff donations

More companies are moving to support workplace giving by employees by matching staff donations, or by contributing to organisations in which staff volunteers are encouraged to contribute their volunteer hours. As one focus group participant said:

We are still committed to supporting existing volunteering initiatives from our employees. We actually give out up to two thousand dollar grants to organisations in which individual employees volunteer on a regular basis. This is very important to small NFPs and makes our employees appreciated in their community. Our employees tell us that they get asked not to leave their current job because the NFPs will then lose the bonus!

Workplace contribution matching funds supplied by a corporation are commonly capped, either in aggregate in a given year, or in relation to an individual donation.

Some participants in focus groups note that they have placed a cap on their matching of workplace giving. This doesn't necessarily relate to the economic downturn - in a number of cases it has been an outcome of the overwhelming response that the recent Victorian bushfires had on workplace donations, resulting in companies reaching their match-giving capacity.

However, corporations are noting that employee awareness of heightened community need is seen in increased interest in matched giving. Some companies say they anticipate a new level of staff giving as a result of the experience of giving during the economic downturn, sometimes similar to the 'tsunami effect', whereby overall levels of giving in Australia increased and were sustained following initial giving in response to a natural disaster (McGregor-Lowndes and Newton 2009).

Chapter 4 Relationships with not-for-profit organisations

This chapter provides insights on development and potential changes in the management of the corporate relationships with not-for-profit organisations, and the day-to-day aspects of the relationship, including communication and personal interactions.

The extent to which companies have changed the way they manage relationships with their NFP partners depends not only on the strategic decisions and approach analysed in the previous chapters, but also the resources made available to public affairs teams managing community investment strategy and budgets.

For companies that have experienced budget and staff cuts, the challenge is greater to maintain focus when managing relationships. These companies are also more demanding of their partners.

We have become tougher towards our NFP partners, and have been asking questions we haven't asked before. We are asking for them to step up and deliver, and want them to demonstrate the value of the relationship and its benefits. We are also toughening a bit on renewals.

We are asking more questions now, because we want to justify our investment.

4.1 Effect of staff cuts

Participants in the focus groups highlighted some challenges related to having less staff in their departments to steward corporate community investments, and how that affects managing relationships with their NFP partners:

We've had pressure on headcount, so had to reassign responsibilities. There's pressure from global head office to resource different areas, so in effect, we received a cut in half a head.

Staff reductions will have an impact on community business partnerships. For example, local partnerships are down. Due to communications cut, it will be hard to do partnerships properly. I was full time social investment and now I have several different areas, so less time to talk to community partners. Almost a sense of going backwards to a transactional model of giving. If you get rid of resources to manage partnerships then you will see an increased trend toward transactional giving. Already we have a small number of large partnerships rather than several smaller partnerships.

Three years ago I was employed just to do community partnerships, now half my time is in other areas of public affairs. This affects closeness of relationships with NFP partners.

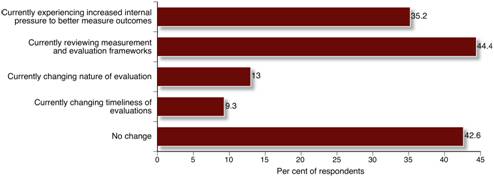

4.2 Approach to measurement and reporting

A significant number of companies are seeking to better measure outcomes and evaluate the impact of their community investment. Forty-four per cent are currently reviewing measurement and evaluation frameworks, while 43 per cent report no change (see Figure 4.1).

Figure 4.1:Changes in approach to better measure outcomes and evaluate impact of community investment programs

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=44.

Several companies participating in the online survey note their community investment measurement and evaluation framework has been reviewed, and this did not necessarily relate to the economic downturn, but was part of an ongoing improvement process. Some companies are also reviewing frameworks because of management changes.

Measurement and reporting has always been a challenging part of managing partnerships, especially in relation to the evaluation of outcomes and investment.

As noted above, there is a growing and deep need to direct corporate resources to social and community needs that can be justified in terms of their efficacy in meeting community objectives, and value in meeting corporate objectives. The scarcer the corporate resource, the more this is the case.

As well as survey respondents, companies participating in the focus groups note an increased shift requiring more accountability for community investment. This was confirmed as a general trend, not just attributable to the downturn.

As one participant notes:

The challenge for the area is to measure real social impact, and if there is a pinch and a squeeze, it becomes more at risk.

4.3 Managing the relationship

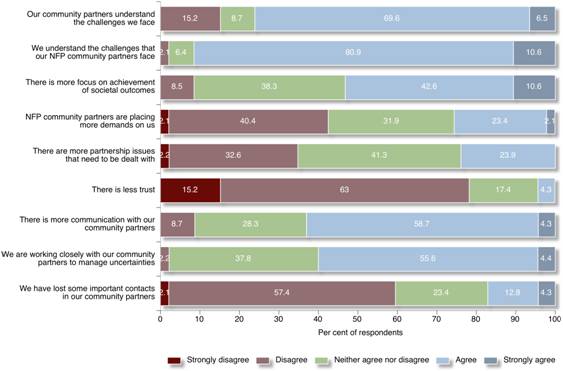

As Figure 4.2 illustrates, companies surveyed overwhelmingly agree that corporations and NFP organisations understand the challenges faced by the other partner.

Companies are mostly 'neutral' on whether the priorities of their community partners are changing.

Sixty-three per cent of companies agree that there is more communication with their community partners. Sixty per cent agree that they are working closely with their partners to manage uncertainties.

The majority (60 per cent) disagree that they have lost important contacts in their community partners.

Companies disagree that their partners are not placing more demands on them, or that there are more partnership issues that need to be dealt with. Seventy-eight per cent of survey respondents also disagree that there is less trust.

There is now more focus on achievement of societal outcomes, according to more than half of the companies we surveyed.

Figure 4.2: Statements on Relationships with NFP Partners

Source: Centre for Corporate Public Affairs, Survey of business executives 2009. N=48.

The qualitative research confirms the survey results that trust and mutual support in company/NFP partnerships have not been damaged by the economic downturn. While there were fewer corporate resources available to maintain desired levels of contact, companies reported considerable discussion of concerns, especially about future funding, between them and existing, close NFP partners.

Companies reported that a number of their community partners were experiencing some economic and capacity stress, and were expecting circumstances to worsen, over the next 12 months. As previously discussed, companies have mostly continued their support, albeit delayed or reduced in some cases. Despite this, focus group participants acknowledge that some of their NFP partners are concerned about what will happen when agreements are rolled over in the next few years.

4.4 Factors for sustainable partnerships

Companies participating in our research identified a number of factors that ensure a sustainable partnership with NFP organisations.

Most companies highlight the importance of regular contact and good communication. They also note the importance of setting clear goals early. These goals are more likely to be sustainable if they align with company and NFP strategic objectives.

Companies in the survey highlighted the importance of measuring outcomes and reporting, so that each organisation understands the progress and value of the partnership.

Box 4.1 illustrates some comments from survey participants about partnership sustainability.

Box 4.2

Regular meaningful consultation and engagement. Development of agreed strategic directions.

Liaise regularly with our partners to understand their needs.

Increased reporting and contact with NFP partners to ensure direction of partnership is to agreed outcomes.

Ensuring from the commencement of the partnership that expectations, timelines and benefits are documented and achievable.

Evaluate programs to fit with our strategy.

Continual review and planning of processes, outcomes and status.

Ensuring there are explicit benefits for both the business and NFP.

Ensure there are activities that are aligned to our business or brand.

Ensure outcomes are measurable and we receive adequate reporting on progress.

Work on building personal relationships but also ensure programs are documented with clearly articulated and agreed goals, objectives and key performance indicators.

By being transparent and delivering what we promise.

Flexible arrangements to adapt to changing business priorities.

Honest communication.

Source: Centre for Corporate Public Affairs, Survey of business executives 2009.

Focus group and interview participants, preferred to focus on longer-term structural issues in relationships. They note, as does the AbaF report cited earlier, that relationships are less vulnerable if they are based on long-term strategic alignment, and more vulnerable if they are based on short term or ad hoc tactical considerations.

On the basis of broader enquiry, and indications from this study, large corporations are seeking to get more value from their relationships.

They have typically structured their community investments into fewer deeper relationships, underpinned by longer-term agreements (typically 3 years minimum). Some have moved to smooth out their community investment spending to enable more sustainable relationships in general and to assist in planning through business cycles.

The companies studied for this report are more likely to be maintaining their relationships and levels of community support compared to small and medium enterprises.

While these trends will tend to benefit larger charities and other NFPs, including community organisations in the neighbourhood of major company facilities, there are negative consequences for others.

They include smaller or less sophisticated NFP organisations that may not be able to satisfy corporate accountability demands, or operate in sectors that are less attractive for corporations seeking alignment with strategy.

Appendices

Appendix A References

- Australia Business Arts Foundation (AbaF) 2009, Arts Sponsorship Outlook Survey 2009 — Summary of findings and recommendations, May.

- Centre for Corporate Public Affairs 2007, Corporate Community Investment in Australia, Centre for Corporate Public Affairs, Melbourne.

- Centre for Corporate Public Affairs 2008, Relationship matters: not-for-profit community organisations and corporate community investment, Centre for Corporate Public Affairs, Sydney.

- McGregor-Lowndes, M & Newton, C 2009, An Examination of Tax Deductible Donations Made by Individual Australian Taxpayers in 2006-07, Working Paper No. CPNS 45, May, Brisbane.

Appendix B List of participant companies

We would like to thank the following companies for participating in this research study, either by attending focus groups, participating in the online survey or meeting individually with the researchers.

This list below also includes those who provided approval to be identified as participating in our online survey. There were other companies that participated who chose to remain anonymous.

- Alcoa

- American Express

- AMP

- ANZ

- BHP Billiton

- BHP Billiton Iron Ore

- BlueScope Steel

- Boral Limited

- BP Australia

- Cadbury

- Chevron

- Citi

- CITIC Pacific Mining

- Citigroup

- Clayton Utz

- Coca-Cola Amatil

- Coles

- Commonwealth Bank

- ConnectEast Group

- CSL Ltd

- EnergyAustralia

- ExxonMobil

- Ford Motor Company

- FOXTEL

- HBF

- IBM Australia

- Integral Energy

- Kimberly-Clark

- Macquarie Group Foundation

- Melbourne Airport

- MetLife

- Microsoft

- National Australia Bank

- Origin Energy

- QER Pty Ltd

- RAC

- Rio Tinto Coal Australia

- Shell

- Sinclair Knight Merz

- Telstra

- Toyota Australia

- Unilever Australasia

- Verve Energy

- Wesfarmers

- Westpac

- Woodside Energy

- Xstrata

Last updated: